Essay on Oligopoly: Top 8 Essays on Oligopoly | Markets | Microeconomics

Here is a compilation of essays on ‘Oligopoly’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Oligopoly’ especially written for school and college students.

Essay on Oligopoly

Essay Contents:

- Essay on Payoff (Profit) Matrix

Essay # 1. Introduction to Oligopoly:

ADVERTISEMENTS:

Two extreme market forms are monopoly (characterised by the existence of a single seller) and perfect competition (characterised by a large number of sellers). Competition is of two types- perfect competition and monopolistic competition. In perfect competition, all sellers sell homogeneous products while in monopolistic competition they sell heterogeneous products. In monopoly there is no rival.

So the monopolist is not concerned with the effect of his actions on rivals. In both types of competition, the number of firms is so large that the actions of any one seller have little, if any, effect on its competitors. An industry with only a few sellers is known as an oligopoly, a firm in such an industry is known as an oligopolist.

Although car-wash is a million rupee business, it is not exactly a product familiar to most consumers. However, often many familiar goods and services are supplied only by a few competing sellers, which means the industries we are talking about are oligopolies. An oligopoly is not necessarily made up of large firms. When a village has only two medicine shops, service there is just as much an oligopoly as air shuttle service between Mumbai and Pune.

Essentially, oligopoly is the result of the same factors that sometimes produce monopoly, but in somewhat weaker form. Honestly, the most important source of oligopoly is the existence of economies of scale, which give better producers a cost advantage over smaller ones. When these economies of scale are very strong, they lead to monopoly, but when they are not that strong they lead to competition among a small number of firms.

Since an oligopoly contains a small number of firms, any change in the firms’ price or output influences the sales and profits of competitors. Each firm must, therefore, recognise that changes in its own policies are likely to elicit changes in the policies of its competitors as well.

As a result of this interdependence, oligopolists face a situation in which the optimal decision of one firm depends on what other firms decide to do. And so there is opportunity for both conflict and cooperation. Oligopoly refers to a market situation in which the number of sellers is few, but greater than one. A special case of oligopoly is monopoly in which there are only two sellers.

Essay # 2. Characteristics of Oligopoly:

The notable characteristics of oligopoly are:

1. Price-Searching Behaviour :

An oligopolist is neither a price-taker (like a competitor) nor a price-maker (like a monopolist). It is a price-searcher. An oligopolist is neither a big enough part of the market to be able to act as a monopolist, nor a small enough part of the market to be able to act as a competitor. But each firm is a dominant part of the market.

In such a situation, competition among buyers will force all the sellers to charge a uniform price for a product. But each firm is sufficiently so large a part of the market that its actions will have noticeable effects upon his rivals. This means that if a single firm changes its output, the prices charged by all the firms will be raised or lowered.

2. Product Characteristics :

In oligopoly, there may be product differentiation as in monopolistic competition (called differentiated oligopoly) or a homogeneous product may be traded by all the few dominant firms (as in pure oligopoly).

3. Interdependence and Uncertainty :

In oligopoly no firm can take decision on price independently. It is because the decision to fix a new price or change an existing price will create reactions among the rival firms. But rivals’ reactions cannot be predicted accurately. If a firm reduces its price its rivals may reduce their prices or they may not. So there is lack of symmetry in the behaviour of rival firms.

This type of reaction of rivals is not found in perfect competition or monopolistic competition where all firms change their price in the same direction and by the same magnitude in order to remain competitive and survive in the long run. So the outcome of a firm’s decision is uncertain.

For this reason it is difficult to predict the total demand for the product of an oligopolistic industry. It is still more difficult, and in some situations virtually impossible, to estimate the share of an individual firm in industry’s output.

It is true that the consequences of attempted price variations on the part of an individual seller are uncertain. His rivals may follow his change, or they may not, but they will, in all likelihood, notice it. The results of any action on the part of an oligopolist or even a duopolist depend upon the reactions of his rivals. In short, it is not possible to define general price- quantity relations for an individual firm, since reaction patterns of rivals are highly uncertain and almost completely unknown.

4. Different Reaction Patterns and Use of Models :

It is not true to say that, in oligopoly, profit is always maximised. It is because an oligopolist does not have control over all the variables which affect his profit. Moreover, a variety of possible reaction patterns is possible in this market—there is a conjectural variation in this market.

Just as firm A’s profit depends on the output of firm B also, firm B’s profit, in its turn, depends on firm A’s output. This is why various models are used to describe the diverse behaviour of oligopoly markets where a variety of outcomes is possible.

5. Non-Price Competition :

As in monopolistic competition there is not only price competition but non-price competition as well in oligopoly (and, to some extent, in duopoly). For example, advertising is often a life and death question in this type of market due to strategic behaviour of all firms. In most oligopoly situations we find intermediate outcomes. Economists are yet to emerge with a definite behaviour pattern in oligopoly.

Essay # 3. Scope of Study of Oligopoly :

Here we study a few of the many possible reaction patterns in duopoly and oligopoly situations. The focus is on pure oligopoly. Here we assume that all firms produce a homogeneous product. We do not discuss the case of differentiated oligopoly and the issue of selling cost (advertising) separately. Of course, we discuss briefly Baumol’s sales maximisation hypothesis—without and with advertising.

The focus here is on the interdependence of the various sellers’ reactions, which is the essential distinguishing feature of oligopoly. If the influence of one seller’s quantity decision from the profit of another, δπ i /δq j , is negligible, the industry must be either perfectly competitive or monopolistically competitive. If δπ i /δq j , is perceptible, the industry is duopolistic or oligopolistic.

The optimum quantity and maximum profit of a duopolist or oligopolist depend upon the actions of the firms belonging to the industry. He can control only his own output level (or price, if his product is differentiated), but he has no direct control over other variables which are likely to (or do) affect his profits. In truth, the profit of each oligopolist is the result of the interaction of the decisions of all players in the market.

Since there are no generally accepted behavioural assumptions for oligopolists and duopolists as is found in other market forms, there are diverse patterns of behaviour and many different solutions for oligopolistic and duopolistic markets. Each solution is based on different types of models and each model is based on a different behavioural assumption or a set of assumptions.

Here we start with one or two simple duopoly models. The same analysis (solution) can be extended to cover any oligopolistic market. The earliest model of duopoly behaviour is the Cournot model, with which we may start our review of different oligopoly models. We end with the game theoretic treatment of oligopoly which shows decision-making under conflict.

Essay # 4. Models of Oligopoly:

1. the cournot model :.

The Cournot model (presented in 1838) is based on the analysis of a market in which two firms produce a homogeneous product. Augustin Cournot (a French economist) noticed that only two firms were producing mineral water for sale. He argued that each firm would choose quantity that would maximise profit, taking the quantity marketed by its competitor as given.

Two main features of the model are:

(i) Each firm chooses a quantity of output instead of price; and

(ii) In choosing its output each firm takes its rival’s output as given.

In Cournot’s model, then, strategies are quantities of output. Here we assume that firms produce a homogeneous good and know the market demand curve.

Each firm must decide how much to produce, and the two firms make their decisions at the same time. When taking its production decision, each duopolist takes into consideration its competitor. It knows that its competitor is also deciding how much to produce, and the market price will depend on the total output of both firms.

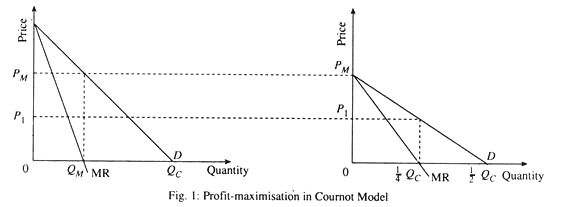

The essence of the Cournot model is that each firm treats the output level of its competitor as fixed and then decides how much to produce. Each Cournot’s duopolist believes that the other’s quantity will not change. In Fig. 1 when I produces Q M , II maximises its profit by producing 1/4Q C . In order to sell Q M plus Q c , the price must fall to P 1 . Here Q M is the monopoly output which is half the competitive output Q c .

The inverse demand function, stating price as a function of the aggregate quantity sold, is expressed as:

P =f (q 1 ) + q 2 … (1)

where q 1 and q 2 are the output levels of the duopolists. The total revenue of each duopolist depends upon his own output level as also as that of his rival:

R 1 = q 1 f 1 (q 1 + q 2 ) = R 1 (q 1 , q 2 )

R 2 = q 2 f 2 (q 1 + q 2 ) = R 2 (q 1 , q 2 ) … (2)

The profit of each equals his total (sales) revenue, less his cost, which depends upon his output level above:

π 1 = R 1 (q 1 , q 2 ) – C 1 (q 1 )

π 2 = R 2 (q 1 , q 2 ) – C 2 (q 2 ) … (3)

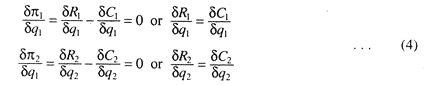

The basic behavioural assumption of the Cournot model is that each duopolist maximises his profit on the assumption that the quantity produced by his rival is invariant with respect to his own decision regarding output quantity. Duopolist I maximises π 1 with reference to q 1 , treating q 2 as a parameter, and duopolist II maximises π 2 , with reference to q 2 , treating q 1 as a parameter. Setting the partial derivatives of (3) equal to zero, we get:

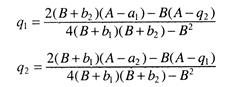

The solution of (7) is

Here OM is the marginal cost of producing the commodity. The second firm’s price is p 2 . The first firm’s profit function is composed of three segments. When p 1 < p 2 , the first firm captures the entire market, and its profit increases as its price increases. When p 1 > p 2 , the two firms split the total profits equal to distance CA, and each makes a profit equal to CB. When p 1 >p 2 , the first firm’s profit is zero because it sells nothing when its price exceeds the second firm’s price.

Criticisms:

The Bertrand model has been criticised on two main grounds. First, when firms produce a homogeneous good, it is more natural to compete by setting quantities rather than prices. Second, even if firms do set prices and choose the same price (as the model predicts), what share of total sales will go to each one? The model assumes that sales would be divided equally among the firms, but there is no reason why this must be the case.

However, despite these shortcomings, the Bertrand model is useful because it shows how the equilibrium outcome in an oligopoly can depend crucially on the firms’ choice of strategic variable.

3. The Stackelberg Model :

The Stackelberg model (presented by the German economist Heinrich von Stackelberg) is a modified version of the Cournot model. In the Cournot model, we assume that two duopolists make their output decisions at the same time. The Stackelberg model examines what happens if one of the firms can set its output first. The Stackelberg model of duopoly is different from the Cournot model, in which neither firm has any opportunity to react.

The model is based on the assumption that the profit of each duopolist is a function of the output levels of both:

π 1 = g 1 (q 1 , q 2 ) π 2 = g 2 (q 1 , q 2 ) … (1)

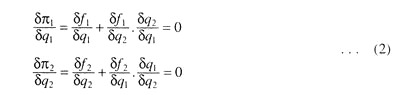

The Cournot solution is found out by maximising π 1 with reference to q 1 , assuming q 2 to be constant and π 2 with reference to q 2 , assuming q 1 to be constant. In general, each firm might make some other assumption about the response (reaction) of its only rival. In such a situation, profit-maximisation by the two duopolists requires the fulfillment of the following two conditions:

Since the firm’s demand curve is kinked, its combined marginal revenue curve is discontinuous. This means that the firm’s cost can change without leading to price change. In this figure, marginal cost could increase but would still equal marginal revenue at the original output level. This means that price remains the same.

The kinked demand curve model fails to explain oligopoly pricing. It says nothing about how marginal revenue firms arrived at the original price P̅ to start with. In fact, some arbitrary price is taken as both the starting and end point of our journey. Why firms did not arrive at some other price remains an open question. It just describes price rigidity but cannot explain it. In addition, the model has not been supported by empirical tests. In reality, rival firms do match price increases as well as price cuts.

Market-sharing Price Leadership :

Oligopolists often collude—jointly restrict supply to raise price and cooperate. This strategy can lead to higher profits. Collusion is, however, illegal. Moreover, one of the main impediments to implicitly collusive pricing is the fact that it is difficult for firms to agree (without talking to each other) on what the price should be.

Coordination becomes particularly problematic when cost and demand conditions—and, thus, the ‘correct’ price—are changing. However, benefits of cooperation can be enjoyed without actually colluding. One way of doing this is through price leadership. Price leadership may be provided by a low-cost firm or a dominant firm.

In this context, we may draw a distinction between price signalling and price leadership. Price signalling is a form of implicit collusion that sometimes gets around this problem. For example, a firm might announce that it has raised its price with the expectation that its competitors will take this announcement as a signal that they should also raise prices. If competitors follow, all of the firms (at least, in the short run) will earn higher profits.

At times, a pattern is established whereby one firm regularly announces price changes and other firms in the industry follow. This type of strategic behaviour is called price leadership— one firm is implicitly recognised as the ‘leader’. The other firms, the ‘price followers’, match its prices. This behaviour solves the problem of coordinating price: Everyone simply charges what the leader is charging.

Price leadership helps to overcome oligopolistic firms’ reluctance to change prices—for fear of being undercut. With changes in cost and demand conditions, firms may find it increasingly necessary to change prices that have remained rigid for some time. In that case, they wait for the leader to signal when and by how much price should change.

Sometimes a large firm will naturally act as a leader; sometimes different firms will act as a leader from time to time. In this context, we may discuss the dominant Firm model of leadership. This is known as market- sharing price leadership.

6. The Dominant Firm Model :

In some oligopolistic markets, one large firm has a major share of total sales while a group of smaller firms meet the residual demand by supplying the remainder of the market. The large firm might then act as a dominant firm, setting a price that maximises its own profits.

The other firms, which individually could exert little, if any, influence over price, would then act as perfect competitors; they all take the price set by the dominant firm as given and produce accordingly. But what price should the dominant firm set? To maximise profit, it must take into account how the output of the other firms depends on the price it sets.

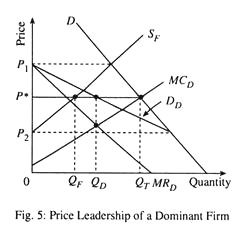

Fig. 5 shows how a dominant firm sets its prices. A dominant firm is one with a large share of total sales that sets price to maximise profits, taking into account the supply response of smaller firms. Here D is the market demand curve and S F is the supply curve (i.e., the aggregate marginal cost curves of the smaller firms, called competitive fringe firms). The dominant firm must determine its demand curve D D .

This curve is just the difference between market demand and the supply of fringe firms. For example, at price P 1 , the supply of fringe firms is just equal to market demand. This means that the dominant firm can sell nothing at this price. At a price P 2 or less, fringe firms will not supply any of the good, in which case, the dominant firm faces the market demand curve. If price lies between P 1 and P 2 , the dominant firm faces the demand curve D D .

The marginal cost curve of the dominant firm corresponding to D D is MR D . The dominant firm’s marginal cost curve is MC D . In order to maximise its profit, the dominant firm produces quantity Q D at the interaction of MR D and MC D . From the demand curve D D , we find P 0 . At this price, fringe firms sell a quantity Q F , thus the total quantity sold is Q T = Q D + Q F .

7. Collusive Oligopoly: The Cartel Model :

Various models have been formulated to explain the strategic behaviour of firms in an oligopolistic market. A price (cut-throat) competition exists among the rivals who try to oust the others from the market. Sometimes there exists a dominant firm that acts as the leader in the market while the others just follow the leader.

As a result, there happens to be a clear possibility of the formation of a cartel by the rival firms in an oligopolistic market in order to eliminate competition among themselves. This is termed as “collusive oligopoly” because the firms somehow manage to combine together in order to behave collectively as a single monopoly.

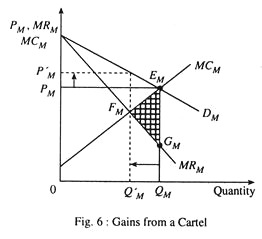

Now let us see graphically what incentives the firms get for forming a cartel. In Fig. 6, the market demand curve is given by the D M the total supply curve is the horizontal summation of the marginal cost curves of all existing firms in the industry, which is denoted by MC M .

The market equilibrium is attained at the point of intersection between the D M (demand curve) and the marginal cost curve MC M , if the firms compete with each other. OP M is the equilibrium price at which the total output of the industry is OQ M .

In order to determine its own quantity, each firm equates this price to its marginal cost. The sum of the quantities of the firms is OQ. If the firms form a cartel in order to act as a monopolist, the price rises to OP ‘ M and the quantity is reduced to OQ ‘ M to be in equilibrium. Now, when the quantity is being reduced by Q M Q’ M , then all the firms together save the cost represented by the area below the MC M curve which is Q M E M F M Q ‘ M .

Thus, a rise in price due to a reduction in the quantity is followed by a decrease in the total revenue represented by the area below the MR M curve, i.e., area Q M G M F M Q’ M . This, in turn, shows that the cost saved exceeds the loss in revenue and, so, all the firms taken as a whole can increase their profit represented by the area E M F M G M . The prospect of earning this extra profit actually acts as the incentive to form a cartel in the oligopoly market structure.

Since the cartel is formed, all firms agree together to produce the total quantity OQ’ M . In order to carry this out, each and every firm is allotted a quota or a certain portion of production such that the sum of all quotas is equal to OQ M . For this, the best way of quota allotment would be to treat each firm as a separate entity (plant) under the same monopolist. Thus, all the firms have the same marginal cost (MC) such that MC = MR (marginal revenue).

Finally, the total profit is maximised because the total output is produced at the minimum cost.

Each and every firm can increase its profit by reducing the profits of other firms, simply by increasing its output quantity above the allotted quota. The system of cartel formation must guard against the desire of individual firms to violate the quota and the cartel breaks down when the cost of guarding against quota violation is very high.

The OPEC is an example of collusive oligopoly or cartel in which members (producers) explicitly agree to cooperate in setting prices and output levels. All the producers in an industry need not and often do not join the cartel. But if most producers adhere to the cartel’s agreements, and if market demand is sufficiently inelastic, the cartel may drive prices well above competitive levels.

Two conditions for success:

Two conditions must be fulfilled for cartel success. First, a stable cartel organisation must be formed whose members agree on price and production levels and both adhere to that agreement. The second condition is the potential for monopoly power. A cartel cannot raise price much if it faces a highly elastic demand curve. If the potential gains from cooperation are large, cartel members will have more incentive to share their organisational problems.

Analysis of Cartel Pricing:

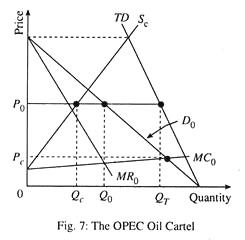

Cartel pricing can be analysed by using the dominant firm model of oligopoly. It is because a cartel usually accounts for only a portion of total production and must take into account the supply response of competitive (non-cartel) producers when it sets price. Here we illustrate the OPEC oil cartel.

Fig. 7 illustrates the case of OPEC. Total demand TD is the world demand curve for crude oil, and S c is the competitive (non-OPEC) supply curve. The demand for OPEC oil D 0 is the difference between total demand (TD) and competitive supply (SC), and MR 0 is the corresponding marginal revenue curve.

MC 0 is OPEC’s marginal cost curve; OPEC has much lower production costs than do non-OPEC producers. OPEC’s marginal revenue and marginal cost are equal at quantity Q 0 , which is the quantity that OPEC will produce. Here we see from OPEC s demand curve that the price will be P 0 .

Since both total demand and non-OPEC supply are inelastic, the demand for OPEC oil is also fairly inelastic; thus the cartel has substantial monopoly. In the 1970s, it used that power to drive prices well above competitive levels.

In this context, it is important to distinguish between short-run and long-run supply and demand curves. The total demand and non-OPEC supply curves in Fig. 7 apply to short-or intermediate-run analysis. In the long run, both demand and supply will be much more elastic, which means that OPEC’s demand curve will also be much more elastic.

We would thus expect that, in the long run, OPEC would be unable to maintain a price that is so much above the competitors’ level. In truth, during 1982-99, oil prices fell steadily, mainly because of the long- run adjustment of demand and non-OPEC supply.

However, cartel is not an unmixed blessing. No doubt cartel members can talk to one another in order to formalize an agreement. But it is not that easy to reach a consensus. Different members may have different costs, different assessments of market demand, and even different objectives, and they may, therefore, want to set prices at different levels.

Furthermore, each member of the cartel will be tempted to “cheat” by lowering its price slightly to capture a larger market share than it was allotted. Most often, only the threat of a long-term return to competitive prices deters cheating of this sort. But if the profits from cartelization are large enough, that threat may be sufficient.

Essay # 5. Sales (Revenue) Maximisation :

W.J. Baumol presented an alternative hypothesis to profit maximisation, viz., sales (revenue) maximisation. He has suggested that large oligopolistic firms do not maximise profit, but rather maximise sales revenue, subject to the constraint that profit equals or exceeds some minimum accepted level. Various empirical studies support Baumol’s hypothesis. And it accurately captures some aspects of oligopolistic firms’ behaviour.

Most important, when firms are uncertain about their demand curve they actually face, or, when they cannot accurately estimate the marginal costs of their output (due to uncertainty about factor prices, or when they produce more than one product), the decision to try to maximise sales appears to be consistent with their long-term survival. This is why many oligopolist firms seek to maximise their market share in order to protect themselves from the adverse effects of uncertain market environment.

Graphical Analysis :

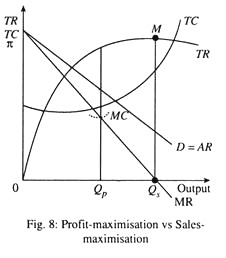

A revenue-maximising oligopolist would choose to produce that level of output for which MR = 0. When MR = 0, TR is maximum. That is, the oligopolist should proceed to the point at which selling any extra unit(s) actually leads to a fall in TR. This choice is illustrated in Fig. 8.

For the firm which faces the demand curve D, TR is maximum when output is q s . For q < q s , MR is positive. This means that selling more units increases TR (though not necessarily profit). For q > q s , however, MR is negative. So further sales actually reduce TR because of price cuts that are necessary to induce consumers to buy more. We know that

MR = P(1 – 1/e p ) … (1)

MR = 0 if e p = 1, in which case TR will be maximum. TR is constant in a small neighbourhood of that output quantity at M 1 P = 0, TR is maximum, and when TR is maximum, e p = 1.

We may now compare the revenue-maximisation choice with the profit-maximising level of output, q s . At q p , MR equals marginal cost MC in Fig. 8. Increasing output beyond q p would reduce profits since MR < MC. Even though TR continues to increase up to q s , units of output beyond q p bring in less than they cost to produce. Since marginal revenue is positive at q p , equation (1) shows that demand must be elastic (e p > 1) at this point.

Essay # 6. Constrained Revenue Maximisation :

A firm that chooses to maximise TR is neither taking into account its costs nor the profitability of the output that it is selling. And it is quite possible that the output level q s in Fig. 8 yields negative profit to the firm. However, it is not possible to any firm to survive for ever with negative profits. So it may be more realistic to assume that firms do meet some minimum level (target rate) of profit from their activities.

Thus, even though oligopolists may be prompted to produce more than q p with a view to maximising revenue, they may produce less than q p units in order to ensure an acceptable level of profit. They will, therefore, behave as constrained revenue maximises and will choose to produce an output level which lies between q p and q s .

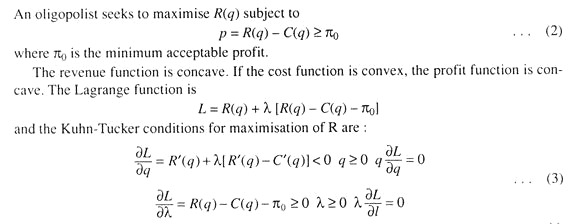

Mathematical Analysis :

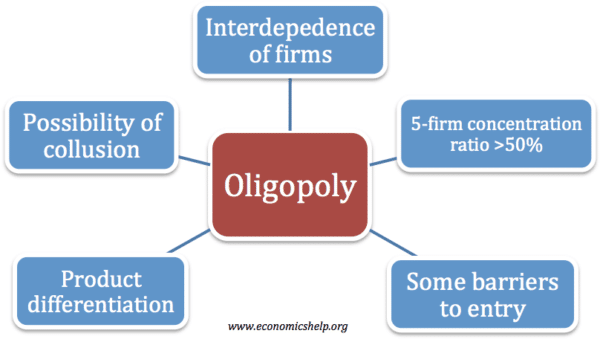

Definition of oligopoly

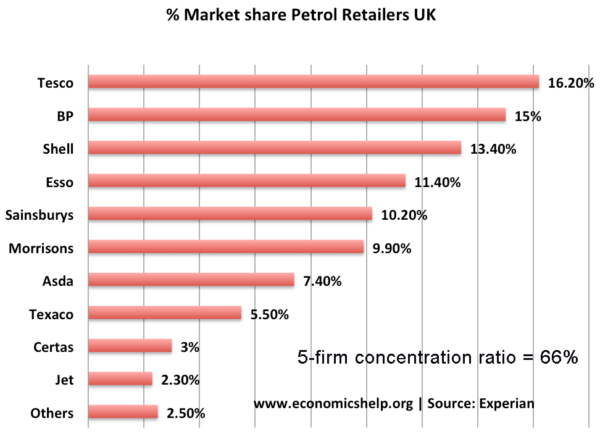

An oligopoly is an industry dominated by a few large firms. For example, an industry with a five-firm concentration ratio of greater than 50% is considered an oligopoly.

Examples of oligopolies

Car industry – economies of scale have caused mergers so big multinationals dominate the market. The biggest car firms include Toyota, Hyundai, Ford, General Motors, VW.

- Petrol retail – see below.

- Pharmaceutical industry

- Coffee shop retail – Starbucks, Costa Coffee, Cafe Nero

- Newspapers – In the UK market share is dominated by tabloids Daily Mail, The Sun, The Mirror, The Star, Daily Express.

- Book retail – In the UK market share is dominated by Waterstones, Amazon and smaller firms like Blackwells.

The main features of oligopoly

- An industry which is dominated by a few firms.

The UK definition of an oligopoly is a five-firm concentration ratio of more than 50% (this means the five biggest firms have more than 50% of the total market share) The above industry (UK petrol) is an example of an oligopoly. See also: Concentration ratios

- Interdependence of firms – companies will be affected by how other firms set price and output.

- Barriers to entry. In an oligopoly, there must be some barriers to entry to enable firms to gain a significant market share. These barriers to entry may include brand loyalty or economies of scale. However, barriers to entry are less than monopoly.

- Differentiated products. In an oligopoly, firms often compete on non-price competition . This makes advertising and the quality of the product are often important.

- Oligopoly is the most common market structure

How firms compete in oligopoly

There are different possible ways that firms in oligopoly will compete and behave this will depend upon:

- The objectives of the firms; e.g. profit maximisation or sales maximisation?

- The degree of contestability; i.e. barriers to entry.

- Government regulation.

There are different possible outcomes for oligopoly:

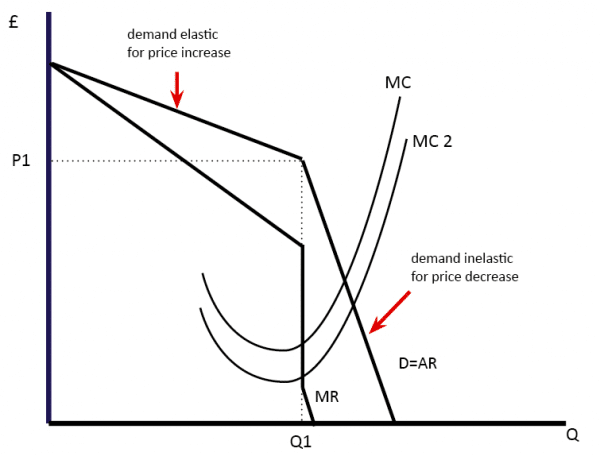

- Stable prices (e.g. through kinked demand curve) – firms concentrate on non-price competition.

- Price wars (competitive oligopoly)

- Collusion- leading to higher prices.

The kinked demand curve model

This model suggests that prices will be fairly stable and there is little incentive for firms to change prices. Therefore, firms compete using non-price competition methods.

- This assumes that firms seek to maximise profits.

- If they increase the price, then they will lose a large share of the market because they become uncompetitive compared to other firms. Therefore demand is elastic for price increases.

- If firms cut price then they would gain a big increase in market share. However, it is unlikely that firms will allow this. Therefore other firms follow suit and cut-price as well. Therefore demand will only increase by a small amount. Therefore demand is inelastic for a price cut.

- Therefore this suggests that prices will be rigid in oligopoly

The diagram above suggests that a change in marginal cost still leads to the same price, because of the kinked demand curve. Profit maximisation occurs where MR = MC at Q1.

Evaluation of kinked demand curve

- In the real world, prices do change.

- Firms may not seek to maximise profits, but prefer to increase market share and so be willing to cut prices, even with inelastic demand.

- Some firms may have very strong brand loyalty and be able to increase the price without demand being very price elastic.

- The model doesn’t suggest how prices were arrived at in the first place.

Firms in an oligopoly may still be very competitive on price, especially if they are seeking to increase market share. In some circumstances, we can see oligopolies where firms are seeking to cut prices and increase competitiveness.

A feature of many oligopolies is selective price wars. For example, supermarkets often compete on the price of some goods (bread/special offers) but set high prices for other goods, such as luxury cake.

- Another possibility for firms in oligopoly is for them to collude on price and set profit maximising levels of output. This maximises profit for the industry.

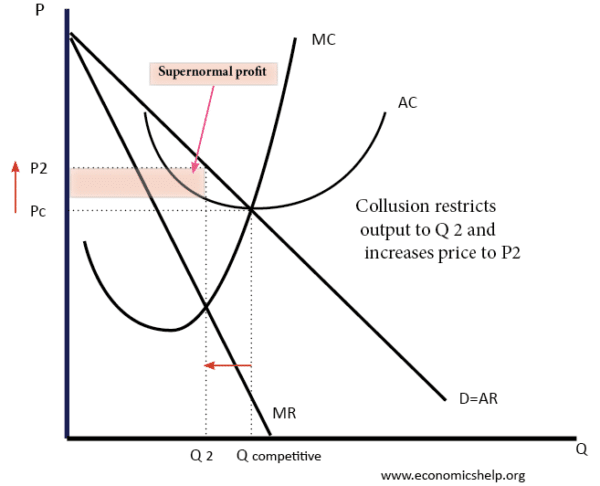

In the above example, the industry was initially competitive (Qc and Pc). However, if firms collude, they can agree to restrict industry supply to Q2, and increase the price to P2. This enables the industry to become more profitable. At Qc, firms made normal profit. But, if they can stick to their quotas and keep the price at P2, they make supernormal profit.

- Collusion is illegal, but tacit collusion may be hard to spot.

- For collusion to be effective, there need to be barriers to entry.

- A cartel is a formal collusive agreement. For example, OPEC is a cartel seeking to control the price of oil.

See: Collusion

Collusion and game theory

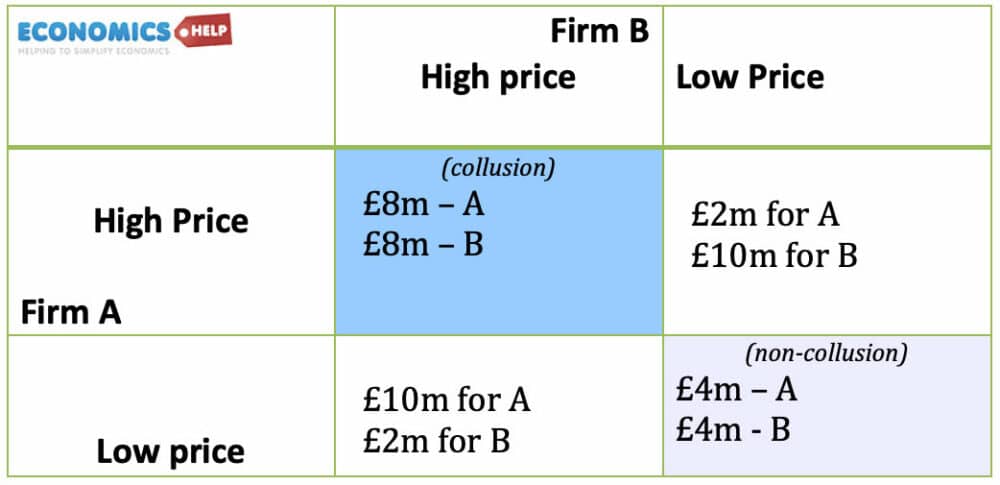

Game theory is looking at the decisions of firms based on the uncertainty of how other firms will react. It illustrates the concept of interdependence. For example, if a firm agrees to collude and set low output – it relies on the other firm sticking to the collusive agreement. If the firm restricts output (sets the High price), and then the other firm betrays its agreement (setting low price). The firm will be worse off.

- This shows different options. If the market is non-collusive, firms make £4m each.

- If they collude, they make £8m.

- But, if they are colluding there is an incentive for one of the firms to exceed quota and increase output. If a firm sets low price whilst the other sets a high price, their profit rises to £10m

Collusion and game theory is more complex if we add in the possibility of firms being fined by a government regulator.

Collusion is illegal and firms can be fined. Usually, the first firm that confesses to the regulator is protected from prosecution, so there is always an incentive to be the first to confess.

- Pricing strategies

- Diagrams for oligopoly

- Game Theory

Marketing91

Oligopoly: Definition, Characteristics, Types and Examples

August 23, 2023 | By Hitesh Bhasin | Filed Under: Marketing

The characteristics of an oligopolistic market structure include interdependent decisions, a kinked demand curve, and competitive behavior among firms. Interdependence means that each firm takes into account the pricing and output decisions of other firms while making its own decision.

This leads to a kinked demand curve which shows how other firms respond when the price of a product is changed. Lastly, competitive behavior among firms means that each firm tries to outdo its competitors by providing better products or services at lower prices.

The photographic equipment industry is an oligopoly market structure , with high entry and exit barriers, which makes it difficult for new entrants to enter the market. Key characteristics of oligopoly market structures are high concentration, mutual interdependence, price leadership, and non-price competition . The competitors in this market structure are few in number, and they are able to influence each other’s decisions.

Table of Contents

What is Oligopoly?

An oligopoly is a market structure in which there are only a few firms that dominate the industry. It is commonly seen in the automobile, airline, steel, and oil industries where only a few firms produce the majority of products or services. For example, the oil industry is largely dominated by only a few large companies.

Oligopoly markets are characterized by only a few firms dominating the industry and this makes it difficult for new firms to enter the market as they cannot compete with the established ones. This can also lead to higher prices and less innovation in the industry.

An oligopoly is a market structure where two or more firms dominate an industry. Characteristics of oligopoly include price rigidity, product differentiation , interdependence, and barriers to entry . The automobile industry , steel industry, airline industry, and oil companies are all examples of oligopolies.

In an oligopoly market structure, firms have the ability to manipulate prices and increase profits. This is due to the few number of large producers in the industry. With few firms, any one firm in the market can significantly impact price and supply. As a result, firms may try to increase prices and limit production in order to gain larger profits.

Characteristics of Oligopoly

1. high barriers to entry.

Oligopoly markets have high barriers to entry. This means that it is difficult for new firms to enter the market as they are unable to compete with the existing ones.

The price-making powers of large firms also make it hard for newcomers to enter.

2. Price Making Power

Oligopolies have significant pricing power, meaning they can charge prices that are much higher than what they’d be able to in more competitive markets.

This is because a few large firms can collude and set a market price, making it difficult for other firms to enter and undercut them.

3. Interdependence Of Firms

In an oligopoly market structure, each firm takes into account the pricing decisions of its competitors while setting its own prices.

That’s because any change in price by one firm will directly impact the profits of other firms as well.

4. Differentiated Products

Oligopolies usually produce products or services which are either differentiated from their rivals or have some kind of brand loyalty associated with them.

This makes customers less likely to switch providers even when there are lower prices available elsewhere.

5. Non-Price Competition

Oligopolies often engage in non-price competition such as advertising , product quality improvement, and provision of better customer service to differentiate their products from competitors.

This helps them gain an edge over rivals and increase market share .

6. A Few Firms with Large Market Shares

In oligopoly markets, a few large firms dominate the industry and control the majority of the market share .

This makes it difficult for new entrants to compete with established ones even if they offer lower prices or better products or services.

7. Few Sellers

Oligopoly markets are characterized by only a few sellers who produce most of the goods and services being offered in the market.

This makes it difficult for new firms to enter the market and compete with existing ones.

8. Each Firm Has Little Market Power In Its Own Right

In an oligopoly market structure, each firm has only little market power in its own right as all of them are dependent on the pricing decisions of other firms.

This means that any change in price by one firm will have an impact on the profits of other firms as well.

9. Higher Prices than Perfect Competition

Oligopoly markets tend to have higher prices than the perfect competition due to the pricing power of large firms, lack of competition, and lack of incentives for firms to lower their prices.

This can lead to higher profits for these firms but can also be detrimental to consumers .

10. More Efficient

Oligopoly markets tend to be more efficient than perfect competition as they allow firms to take advantage of economies of scale and focus on producing the best quality products at the lowest cost.

This helps them achieve higher profits without having to worry about competing on price.

11. Advertising

Large companies in oligopoly markets often engage in advertising campaigns to differentiate their products from competitors and increase brand loyalty .

This helps them gain an edge over rivals and increase market share, even when other firms offer lower prices or better quality products.

12. Group Behaviour

In oligopoly markets, firms usually act in a group rather than individually due to interdependence among them.

This means that each firm takes into account the pricing decisions of its competitors while setting its own prices.

13. Competition

Oligopoly markets are characterized by competition among a few large firms as opposed to a perfect competition where many small firms compete against each other.

This means that these firms can collude and set a market price, making it difficult for other firms to enter the market and undercut them.

14. Barriers To Entry Of Firms

In oligopoly markets, there are usually high barriers to entry due to economies of scale, the presence of large firms, and brand loyalty from customers.

This makes it very difficult for new entrants to compete with established ones even if they offer lower prices or better products or services.

15. Lack Of Uniformity

Due to the number of firms in the market and their different strategies , oligopoly markets lack uniformity.

This means that prices charged by each firm can be quite different from those set by its rivals.

16. Existence Of Price Rigidity

Since firms in oligopoly markets depend on the pricing decisions of other companies, prices often stay steady.

This is known as price rigidity and it can lead to reduced competition in the market and higher prices for consumers.

17. No Unique Pattern Of Pricing Behaviour

In oligopolistic markets, the pricing strategies adopted by firms are not constrained to any one particular pattern.

This means that each firm has to take into account the pricing decisions of its rivals and adjust its own prices accordingly in order to remain competitive.

18. Indeterminateness Of Demand Curve

In oligopoly markets, due to the fact that firms are interdependent on each other’s pricing decisions, it is difficult to determine a unique demand curve for any given product or service. This means that firms have to rely on the pricing decisions of their rivals in order to set their own prices.

Overall, Characteristics of oligopoly markets include higher prices than perfect competition, more efficient production, advertising campaigns, group behavior among firms, barriers to entry of firms, lack of uniformity in pricing amongst competitors, and the existence of price rigidity.

Furthermore, these markets are characterized by no unique pattern of pricing behavior and the indeterminateness of the demand curve.

Types of Oligopoly

Pure Oligopoly: In a pure oligopoly, there are only two or three firms in the market that are not influenced by any other firm. This oligopoly environment is rife with fierce competition, as each business relentlessly fights to dominate the market.

Imperfect Oligopoly: In an imperfect oligopoly, there is more than one dominant firm but the market is still dominated by a few key players. In this type of oligopolistic market, companies work together to maximize their profits by fixing prices and engaging in less fierce competition.

Open Oligopoly: In an open oligopoly, there are many small firms in the market that can compete with each other but are not able to gain control over the entire market. This oligopoly is marked by price battles and strategic campaigns, as each company attempts to capitalize on the adversaries’ vulnerable spots.

Closed Oligopoly: In a closed oligopoly, there are few firms in the market and they have gained dominance over the entire industry. In this form of oligopoly, firms have secured a certain degree of market dominance, leading to an absence of competition.

Collusive Oligopoly: In a collusive oligopoly, firms form agreements to set prices and production levels in order to maximize their collective profits. Oligopolies of this nature are typified by both price stability and lucrative profits for all businesses involved.

Competitive Oligopoly: In a competitive oligopoly, there are few large firms but they compete aggressively with each other through pricing strategies, promotions, and advertising campaigns. This oligopoly structure is typified by fierce rivalry and prices that are considerably lower than those encountered in traditional or distorted oligopolies.

Partial Oligopoly: In a partial oligopoly, there are a few large firms that dominate the market but there are also many small firms that compete with each other. This oligopoly is defined by the intense rivalry among small firms and an incapability to control the entire market by any one firm.

Total Oligopoly: In a total oligopoly, only one firm has control over the entire industry and its pricing strategies govern the market. This type of oligopoly is known for its stable prices and exceptional returns to the primary business.

Organized Oligopoly: In an organized oligopoly, several large firms cooperate with each other in order to gain control over the entire market. This type of oligopoly is characterized by stable prices and increased profits for all participating firms.

Syndicated Oligopoly: In a syndicated oligopoly, several firms join together in order to gain control over the entire market. This type of oligopoly results in steady pricing increased profits for the firms involved, and a decrease in market competition.

Examples of Oligopoly

Motor Vehicles in the US: In the United States, motor vehicles are a prime example of an oligopoly. The US market is primarily dominated by three firms: General Motors , Ford , and Chrysler , which together account for approximately 70% of the total sales.

News Media: The news media industry is another example of an oligopoly, as there are only a few large media companies that control the entire market. These companies, such as NBC Universal, Disney , and Time Warner, are known for their immense power when it comes to influencing public opinion.

Breakfast Cereals: The breakfast cereals industry is an oligopoly in which only a handful of firms have significant control over the entire market. Companies like Kellogg’s, Quaker Oats, and General Mills dominate the global market for breakfast cereals.

Mobile Phones: The mobile phone industry is dominated by a few large players such as Apple , HTC , and Samsung . These companies have secured an overwhelming portion of the total market share, leaving only marginal room for new entrants or small businesses.

Beer: The beer industry is a prime example of an oligopoly, as it is dominated by only a few large firms. Companies like Anheuser-Busch InBev, MillerCoors, and Heineken control more than 70% of the total market share in the United States.

Conclusion!

In the end, oligopoly industries have characteristics that make them distinct from other market structures. They work in a competitive market and require businesses to be savvy in order to stay competitive.

Oligopoly industries can be difficult to enter and exit, as the few firms in the market tend to hold significant market power. Market forces of demand and supply still apply, however firms are more likely to focus on strategic pricing decisions in order to maximize profits. The marginal revenue curve is an important concept to understand in oligopolies, as it can provide guidance on how much revenue a firm will gain from a given price.

Understanding the oligopoly characteristics will give businesses an edge in making strategic decisions and staying competitive in their markets. In a world of intense competition, businesses in these industries must be prepared to adapt quickly in order to remain successful.

Liked this post? Check out the complete series on Marketing

Related posts:

- Types of Competition: Perfect, Monopoly, Monopolistic & Oligopoly

- Competitive Market: Definition, Types, Characteristics and Examples

- What is Television Advertising?

- Internal Customers – Definition, Examples and Characteristics

- Characteristics of Services and Their Examples

- Secondary Data – Characteristics, Advantages and Examples

- Descriptive Research – Characteristics, Methods, Examples, Advantages

- Shopping Products – Characteristics and Types

- Questionnaire: Definition, Characteristics & Advantages

- Industrial Marketing – Definition, Strategy and Characteristics

About Hitesh Bhasin

Hitesh Bhasin is the CEO of Marketing91 and has over a decade of experience in the marketing field. He is an accomplished author of thousands of insightful articles, including in-depth analyses of brands and companies. Holding an MBA in Marketing, Hitesh manages several offline ventures, where he applies all the concepts of Marketing that he writes about.

All Knowledge Banks (Hub Pages)

- Marketing Hub

- Management Hub

- Marketing Strategy

- Advertising Hub

- Branding Hub

- Market Research

- Small Business Marketing

- Sales and Selling

- Marketing Careers

- Internet Marketing

- Business Model of Brands

- Marketing Mix of Brands

- Brand Competitors

- Strategy of Brands

- SWOT of Brands

- Customer Management

- Top 10 Lists

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- About Marketing91

- Marketing91 Team

- Privacy Policy

- Cookie Policy

- Terms of Use

- Editorial Policy

WE WRITE ON

- Digital Marketing

- Human Resources

- Operations Management

- Marketing News

- Marketing mix's

- Competitors

What Makes a Market an Oligopoly?

Do you know of any industries in which just three or four companies supply most of a specific product?

Some examples:

- From the 1950s to the 1980s, three major broadcast television networks dominated the U.S. airwaves.

- After a series of mergers between 2005 and 2015, four major airlines controlled much of the U.S. market, as a November 2018 Page One Economics essay described.

- Even more recently, shortages and price increases brought attention to the U.S. baby formula market and global insulin market, which also had just a few suppliers.

Those markets could be considered “oligopolies”—markets in which only a few sellers or suppliers dominate.

Suppliers and sellers in an oligopoly can command higher prices than companies in a competitive market, and if one company in an oligopoly stops producing, it has a bigger effect on supply than it would in a competitive market.

Read on for more comparisons of oligopolies to other types of markets and to learn how to tell whether a particular market could be considered an oligopoly.

What Is an Oligopoly?

As the table shows, in addition to having only a few sellers or suppliers dominating the market, an oligopoly has barriers to entering the market, and “there are few close substitutes for the product.”

In other words, certain conditions make it difficult for potential competitors to start selling or supplying a particular product or service within that industry, and there aren’t many alternatives that could be used instead. Monopolies—markets in which one firm dominates—also have those barriers.

“Barriers to entry” could include factors such as costly equipment needed to produce a product, patents restricting who can use an invention, and government regulations that are difficult to meet, as a Corporate Finance Institute article outlined.

What Are Examples of Barriers to Entry?

In the case of the U.S. infant formula market, barriers to entry have included tariffs and Food and Drug Administration standards . (Some of the infant formula market barriers were waived to help ease the shortage last year.)

Until the expansion of the cable TV market in the 1980s, the limited availability of broadcast frequencies helped to restrict the number of television networks, with the Federal Communications Commission in charge of allocating portions of the broadcast spectrum to stations.

Barriers to entry in the airline industry include high startup costs, such as for purchasing airplanes, competition for airport gates and large economies of scale, the Page One Economics essay said.

Government can put up barriers, as a St. Louis Fed Econ Lowdown lesson on market structures (PDF) outlined in discussing monopolistic markets. Such markets are rare, according to the lesson.

“Most commonly, [monopolistic markets] occur because government has granted a single firm the opportunity to supply a good or service. This is known as a ‘natural monopoly, ’ ” according to the lesson, which gives the examples of electric and natural gas providers. Because of the expensive infrastructure needed for those services, such as wires and pipes entering people’s homes, it’s cheaper for one firm to provide the service than to build infrastructure needed for true competition.

“In exchange, government often regulates prices in these markets to ensure that these firms do not take advantage of their market power,” the lesson says.

How Can You Tell If a Market Is an Oligopoly?

A “concentration ratio” is one tool that can indicate whether a market is an oligopoly.

A concentration ratio is the combined market share of the largest firms in an industry, according to Oxford Reference . That is, it’s the percentage of the industry’s products or services provided by those firms.

The number of firms used for the ratio can vary. A “four-firm” ratio is often used as a benchmark to show market structure, according to Oxford. But the ratios also can be calculated using the market share from the eight, five or three largest firms in the market, according to a September 2020 Investopedia article.

“A rule of thumb is that an oligopoly exists when the top five firms in the market account for more than 60% of total market sales,” the article says. “If the concentration ratio of one company is equal to 100%, this indicates that the industry is a monopoly.”

In 2015, the four major airlines controlled 80% of the U.S. market, the Page One Economics essay said. Three manufacturers have more than 90% of the global insulin market , according to a July 2022 press release from Grand View Research, a global market research and consulting company. That would make those markets oligopolies, according to the Investopedia rule of thumb.

What Are Two Types of Oligopolistic Markets?

Oligopolistic markets differ, and different types of markets have different effects on prices, as the Econ Lowdown lesson illustrates.

One such market is a collusive oligopoly , which has a few sellers who work together “to divide the market, set prices, or limit production,” the lesson says. Companies might, for example, agree to limit production to drive up prices. Such collusion is often illegal.

In a competitive oligopoly , the few sellers compete, which keeps the prices lower than they would be in a collusive oligopoly.

In general, more competition results in lower prices for consumers. So, a perfect competition market structure, in which lots of companies provide the same product, would result in lower prices, while a monopoly could mean the highest prices for consumers. Depending on whether they are collusive or competitive, oligopolies can be more like monopolies or more like perfect competition, respectively, as a Khan Academy video explains.

Can Oligopolies Change?

Market structures aren’t necessarily fixed, as the Page One Economics essay illustrated with the example of U.S. airlines.

Airline ticket prices declined as low-cost carriers started expanding their routes in 2016, the essay said. A chart from online database FRED shows the downward trend in airfares before the COVID-19 pandemic.

“The proliferation of low-cost flights in recent years has pushed the airline industry, which was arguably an oligopoly, toward monopolistic competition,” the essay said.

Heather Hennerich is a senior editor with the St. Louis Fed External Engagement and Corporate Communications Division.

Related Topics

This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Media questions

All other blog-related questions

An oligopoly is a market in which a few firms dominate, and an oligopolist is one of these dominant firms. While 'a few' is an imprecise number, economists generally look at the market shares of the top three, four or five firms - if these firms control most of the market, then the firms are oligopolists.

How is the degree of oligopoly measured?

Concentration ratios.

Concentration ratios (or CRs) can be used to help identify whether the firm operates under conditions of oligopoly. Concentration refers to the extent to which market power is in the hands of a small number of firms. Concentration ratios show the combined market shares of the top few firms as a ratio of the total market size, expressed as a percentage.

When markets are highly concentrated the conduct of firms and their efficiency is likely to be sub-optimal. [Read more on market structure and conduct .]

For example, the global music shares of the top producers are:

Universal Music, 31% Sony Music, 21% Warner Music, 18% Independents, 27% Artists Direct, 3% Source: MIDIA (2019),

This makes the three-firm CR 70% - indicating oligopoly conditions.

The H-H Index

he Herfindahl–Hirschman Index (HH-Index) is an alternative measure of market concentration in an industry. It is calculated by adding the squared market shares of the top few firms in a market. The higher the number, the greater the degree of concentration.

The maximum figure possible is for a single monopolist, which is 100 (%) x 100 (%) = 10,000 .

For example, let's assume that the market shares of the largest three firms in a hypothetical market are: Firm A = 35%, Firm B = 25%, and Firm C = 20%.

The H-H Index would give 35 2 + 30 2 + 25 2 , which equals:

1,225 + 625 + 400 = 2350 .

Example - UK Supermarkets

The top four UK supermarkets in 2022 by market share were Tesco, with 26.9%, Sainsbury, with 14.6%, ASDA with 14.1%, and Morrisons, with 9.1%.

The H-H Index for the top four supermarkets in the UK in 2022 was 1222.

Generally, an H-H Index of more than 1200 indicates a high degree of concentration and suggests the market is an oligopoly.

Read more: Changing concentration in the UK electricity market

Key characteristics and features of oligopoly

Firms are interdependent.

As there are only a few other competitors in the market, the profit available to a single oligopolist is constrained by the actions and decisions taken by the other firms in the market.

For example, if one oligopolist - firm A - decides to reduce its price in the hope of gaining market share, and the two other firms in the market - B and C - also reduce their prices in response, firm A's strategy will have been thwarted. An oligopolist needs to anticipate and respond to the actions and behaviour of rivals. The need to take rivals into account when making decisions is referred to as mutual interdependence .

Uncertainty

Given the importance of interdependence, oligopolists face high levels of uncertainty, perhaps never being able to fully predict the behaviour of close rivals. This explains the temptation to reduce competition and the attempt to co-operate with close rivals to reduce uncertainty.

The importance of strategy

As a result of interdependence, oligopolists must try to anticipate the likely response of rivals to any change in policy concerning price or to non-price decisions. Non-price decisions include decisions about the product itself, how it is distributed, how it is marketed and advertised.

Strategy is especially important for oligopolies that cannot easily differentiate their good or service, such as petrol retailers. If they can differentiate, they become less interdependent and more able to act independently.

Differentiated or undifferentiated?

Oligopolists may operate in markets where differentiation is difficult - such as the market for refined white sugar, or where differentiation is much easier - such as oligopolists in the motor manufacturing industry.

Competition or collusion?

It follows that a key feature of oligopolies is that key decisions must be made about whether firms actively compete with each other, or whether they limit competition. Competition can be reduced when firms collude with each other and act jointly to enable all firms to reduce uncertainty and increase the level of profits (or other benefits) available to the 'group' of firms.

Types of collusion

Oligopolists can engage in overt (open) collusion by establishing an agreement to reduce competition or to collaborate in some way. For example, members of cartels may create agreements to fix output or price, or other aspects of the market. While 'overt' collusion to fix prices is clearly anti-competitive, and therefore unlawful in most countries, other forms of collusion may be hidden and difficult to legislate for, and to police.

Covert collusion arises when oligopolists conspire to 'rig' a market by having agreements which are hidden and secret. In some cases, members may 'whistle-blow' in the hope that they may avoid any punishment if the collusion is discovered by the relevant competition authority. This is more likely if authorities offer incentives to whistle-blow.

Tacit collusion arises when firms appear to adopt a similar policy on price or non-price aspects of their business, but there is no agreement between them. This may not involve any collusion in the legal sense, and need not involve communication between firms. However, the outcomes (such as higher prices or reduced output) may well resemble those that arise from explicit collusion.

Tacit collusion may arise when firms follow rules which are understood rather than written down. For example, in an oligopoly market with three firms, it may be understood that firm A takes the lead in making a change to price, or to a non-price activity, and firms B and C simply follow the lead. This arrangement is not written and there may be no conscious attempt to rig the market. Price leadership is arguably the commonest form of tacit collusion - in this case, there is no conspiracy to act unlawfully.

From a legal perspective, anti-trust law is concerned with the process of collusion, rather than the outcome, and there must be a conscious commitment to achieve an unlawful outcome.

Types of competition

Oligopolists may prefer to compete, rather than collude, especially if the penalties for anti-competitive behaviour are significant (such as fines, being forced to wind-up, or loss of reputation if discovered.)

Competition can either involve competing on price - price competition - or competing in non-price ways - non-price competition .

For the oligopolist, price competition is risky as it can lead to retaliation, and to a price-war which can lead to falling profits for all firms in the industry. This explains the preference for non-price competition . For example, rather than compete on the price of their core product (petrol/'gas'), petrol retailers may compete through special promotions, through advertising, and by developing a respected brand.

Pricing strategies can also be introduced that reduce competition, such as cost-plus pricing . Cost-plus pricing exists when the oligopolist sets a selling price as a fixed mark-up above average production costs.

For example, insurance companies may set a fixed 20% mark-up above all their costs, including all the predicted claims costs. If all insurance companies share similar costs, then any sudden change in costs - such as following a particularly harsh winter, will result in all insurance companies raising their prices (called premiums) by the same or a very similar amount.

Barriers to entry

Oligopolists can maintain their relative dominance by benefitting from barriers to entry. These include expenditure on advertising and the strength of the brand in deterring entry; the benefit of economies of scale ; collusion between oligopolists; and pricing strategies to deter entry, such as limit pricing - setting a low price to limit the entry of new firms.

Read more on barriers to entry

Price-stickiness - the oligopolists kinked-demand curve

Prices in oligopolistic markets tend to 'stick' - often for lengthy periods - even when market conditions change. This can be explained though the kinked-demand curve .

The oligopolist faces two demand scenarios:

Firstly, when demand is elastic following a price rise , and secondly when demand is inelastic in response to a price drop .

In both scenarios, the firm is worse off - at least in terms of revenue. Raising price creates an elastic reaction, and lowering price creates an inelastic reaction. In both case, revenue is less than achieved at the original price.

Profits will also be maximised at the original price

Profit maximisation occurs where marginal cost (MC) cuts marginal revenue (MR). For the oligopolist, this may occur in the vertical section of the MR curve, between A and B. The level of profit depends upon the position of the ATC curve.

Once price is set, the kinked demand curve implies that the price sticks at P.

Even when we factor in the possibility of cost changes, the price will stick at its original level. Changes in costs have no effect at all if MC remains between A and B (the discontinuous portion of the oligopolist's MR curve). Even when MC moves outside of this range, price hardly changes.

Price stickiness and interdependence can also be explained through Game Theory .

Integration

Oligopolists tend to emerge over time through integration with other firms.

Integration can either be horizontal - between firms at the same stage of production (such as two airlines merging) - or vertical, which involves the integration of firms from different stages in production.

Vertical integration can be in one of two directions - backward, where one firm integrates with a firm which is nearer to the source of supply (such as a TV company purchasing a soccer team) or forward, which is where a producer integrates with a firm nearer to the final consumer (such as a farmer acquiring a grocery store.)

Numerical example

Why the oligopolist's demand curve is 'kinked' is a question that can be appreciated by considering a cost-revenue schedule.

Here we can see that the firm's average revenue curve falls with quantity, but because there are two different reactions to price - elastic for a rise, and inelastic for a fall - there is a kink in the demand (AR) curve and the MR curve will have a discontinuous portion (between output 6 and 7, as highlighted in the schedule).

The elastic response to the price rise results from rivals not changing their price in response, whereas the inelastic response to a price drop results in rivals being forced to 'follow suit' given that rivals would experience a considerable fall in market share if they did not reduce price.

If we transfer the figures to a graph we arrive at the classic kinked demand curve. Profits are maximised at output 6 (and price 75), which is where marginal cost (MC) equals marginal revenue (MR).

The area for super-normal profits is also highlighted.

- > Economics

What is Oligopoly: Types, Characteristics and Examples

- Pragya Soni

- Dec 18, 2021

Though, the British ruled period was a time of monopoly trade. But today, when globalization is at its peak, oligopoly is emerging as the leading market strategy. While the governments of a few countries are promoting it, others are banning it.

Now the question arises, what is oligopoly in real life? How to identify it from monopoly? And if it is stable for the market or not. In this blog we will answer all your questions. We will read about the definition of an oligopoly market, its characteristics and consider a few real-life examples.

(Learn about Experimental economics )

What is the meaning of Oligopoly ?

The term oligopoly is basically related to economics and the market. It is a market controlling term. It may be defined as a market situation in which only a few producers affect the market.

But that doesn’t mean they entirely control the market. The price change of each producer affects the actions of other producers. For instance, a reduction in the price of one producer may lead to an equal deduction by the other producers.

This practice helps in retaining the same earlier share of the market but at lower profits. In oligopolistic industries the process is generally a blend of monopolistic and competitive tendencies. Oligopolies can be followed in several industries such as steel, aluminum and automobile industries.

In other words, oligopoly is defined as the market strategy that consists of several small numbers of firms. These firms or producers work explicitly to restrict output and thus control the market returns.

(Check out - What is Capital in Economics )

Types of oligopoly

Oligopoly market industries or oligopolistic strategies are classified into following types:

Pure oligopoly

Pure oligopoly is also known as perfect oligopoly. This strategy has a homogeneous product. For example, the aluminum industry.

Imperfect oligopoly

Imperfect oligopoly is also known as differentiated oligopoly. This industry has product differentiation at the end. For example, the talcum industry.

Open oligopoly

Open oligopoly refers to the market strategy where the new industries can enter in the market and can compete with the existing industries.

Closed oligopoly

Closed oligopoly is the opposite of open oligopoly. Here the entry of new or other industries into the market is strictly banned.

Collusive oligopoly

Collusive oligopoly is basically a cooperative market strategy. It occurs when few firms collaborate to an understanding in reference to the price and results of the products.

Competitive oligopoly

Competitive oligopoly is the opposite of collusive oligopoly and basically a competitive strategy. This type of oligopoly occurs due to lack of understanding between the industries of the market. Due to which they create invariable competition for one another.

Partial oligopoly

In this strategy there exists an industry as the price leader. The situation when a particular firm or industry is more powerful in the market as compared to other industries. A large firm basically dominates the entire market.

Total oligopoly

Total oligopoly is also known as partial oligopoly. It is the opposite of partial oligopoly and no particular industry or firm dominates the market. There is no price leadership in the market.

Organized oligopoly

As the name suggests this is an organized structure of oligopoly. In this strategy, an association is formed to fix prices, quotas, and output.

Syndicated oligopoly

Syndicated oligopoly is the opposite of organized oligopoly. In this strategy the industries are allowed to sell their product through a centralized syndicate.

(Read, Difference between macro and microeconomics )

What are the characteristics of oligopoly ?

Characteristics of oligopoly

The characteristics of an oligopoly market or oligopolistic strategy are mentioned below:

Interdependence

As in an oligopoly market, the decision of one firm influences the process and working of another firm. Thus, it induces interdependence in the network. It is the most important feature of an oligopolistic market. As this affects the prices and output of the market. A small change in a small firm has a direct impact on its rivals.

In order to match the impacts induced, the competitor firms might change their prices and profits. Thus, the oligopoly market is a totally interdependent network.

Advertising

Advertising is the key characteristic of the oligopolistic market. The firms are supposed to employ aggressive market techniques to defend the competition in the market. Due to interdependence, it is essential for the forms to invest a huge amount in the marketing and promotional activities. Thus, advertising has a great importance in an oligopoly strategy.

Variable selling price

An oligopolistic market is a factor driven market and has interdependence on various factors. Thus, the selling price of the products in this market is quite unstable and varies at different instances.

Group behavior

The process of oligopoly is a group behavior. It is designed in such a way that a single firm can execute selfish behavior or profit-maximizing behavior. If it does, it automatically goes against the fundamentals of an oligopolistic market.

Entry barriers

Generally, it is difficult to enter an oligopolistic market, even in an open oligopoly. As it has to compete as a small start-up industry with large and economically stable firms. Here the most common entry barriers that are observed are as follows:

Exclusive resource ownership

Patents and copyrights

High start-up cost

Government restrictions

Few leading firms

There are only a few firms that control the entire sales and process of the market. In other words, the large number of firms is quite small in an oligopolistic market.

Identical or differentiated products

Unlike, monopoly market, the oligopoly market produces both kinds of goods, that is identical products and different products.

(Suggested Read - What is Deflation? )

How is oligopoly different from monopoly ?

In the modern era, there exist different market strategies such as monopoly and duopoly. Monopoly market refers to a market having only one producer. Similarly, duopoly has two producers in the market.

While oligopoly is the market strategy that involves a number of producers in the market. The upper limit of the number of producers in oligopoly is not fixed. But generally, the number is maintained in such a way that the decision and action of one industry or producer must affect and influence the others.

(Check out - Recession vs Depression )

What are the major examples of oligopoly market strategy ?

Examples of Oligopoly

In the modern era oligopoly is the most common market practice. The major examples of oligopoly markets are as follows:

Pharmaceutical sector

The pharmaceutical market is the most leading global market. It not only leads in drug innovation but also acts as a drug price maker. The pharmaceutical sector is a real example of oligopoly.

As the market is controlled by top firms such as Merck, Pfizer and Abbott. The entry for new firms in this sector is quite limited and restricted. As the patents are being registered here, it creates a notebook of experience for the future. Also, it can produce both similar and different products.

Media sector

Media sector is also a kind of oligopoly industry. Comparing the case of India, almost 90% of this sector is captured by leaders such as, The Tribune, ABP news etc. the decision of one producer totally influences the decision of other firms.

And, if we minutely observe, the sector shows group behavior as well. And not a particular producer has the lead. You can yourself check that the prime time for every channel is different. This sector also invests huge amounts in advertising.

Computer technology industry

This sector is a best example of oligopoly. The entire computer technology market is globally dominated by two leaders named Apple and Windows. Due to their economic growth across the globe, no other firm is trying to enter in this sector.

No matter what computer you choose, the embedded technology will be one of these two only. Thus, this sector serves a perfect example for a closed oligopolistic market.

Automobile industry

Similarly, the automobile industry is also an example of oligopoly. Let us take the case of India, no doubt, there are several automobile industries. But a dozen of them rule the market.

These include Hyundai, Maruti, etc. Automobile sector is an example of organized oligopoly. As the standards and prices here are maintained by a generated authority.

Other examples of oligopoly strategy include following industries:

The steel industry

The petroleum industry

The photographic equipment industry

The cereal industry

The wine and beer sector

The aircraft manufacturing sector

The beverage industry

The gold jewelry makers

(Difference between Positive and Normative economics )

The profits maximization of an oligopoly market is governed by the Kinked demand curve. Oligopoly industries are more stable over other market strategies as they work on collaboration. Thus, they are more beneficial in the era of economic competition.

This strategy also avoids evil practices such as price-fixing. And identifies a price leader in the market, the other firms follow the price leader to maximize their benefits. The government must take essential efforts to expand the network of oligopolistic markets.

Share Blog :

Be a part of our Instagram community

Trending blogs

5 Factors Influencing Consumer Behavior

Elasticity of Demand and its Types

What is PESTLE Analysis? Everything you need to know about it

An Overview of Descriptive Analysis

What is Managerial Economics? Definition, Types, Nature, Principles, and Scope

5 Factors Affecting the Price Elasticity of Demand (PED)

6 Major Branches of Artificial Intelligence (AI)

Dijkstra’s Algorithm: The Shortest Path Algorithm

Scope of Managerial Economics

Different Types of Research Methods

Latest Comments

Final dates! Join the tutor2u subject teams in London for a day of exam technique and revision at the cinema. Learn more →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

- Exam Support

Essay on Oligopoly and Collusion

Last updated 3 Feb 2019

- Share on Facebook

- Share on Twitter

- Share by Email

Here is what I feel is a superbly clear and well-structured essay answer to a question on the economic and social effects of collusion within an oligopoly.

Evaluate the view that collusion between firms in an oligopoly always works against consumer and society’s interests. Use game theory in your answer.