What are your chances of acceptance?

Calculate for all schools, your chance of acceptance.

Your chancing factors

Extracurriculars.

Frequently Asked Questions About the FAFSA

This article was written based on the information and opinions presented by Vinay Bhaskara in a CollegeVine livestream. You can watch the full livestream for more info.

What’s Covered:

Student demographics, school selection, parent demographics, parent financials, student financials.

In this article, we will provide answers to some frequently asked questions about completing the various sections of the FAFSA. For more information refer to The Ultimate Guide to Filling Out the FAFSA .

Do EAD card holders identify as citizens?

EAD card holders are usually ineligible non-citizens. Only green card holders or those with DACA, DAPA, or refugee status qualify as eligible non-citizens.

Are trans students required to register with the Selective Service System?

The answer depends on where you fall on the trans identity spectrum. If you are an MTF (male-to-female) student, then you have to register. If you are an FTM (female-to-male) student, then you do not need to register. The response you submit depends on the sex you were assigned at birth.

How do you indicate that a student is homeschooled?

Visit the “Student Demographics” section of the FAFSA and respond “homeschooled” to question 26: Has the student completed high school or an equivalent? Selecting “homeschooled” will remove questions related to high school from the application.

How do you submit the FAFSA if you are applying to more than 10 schools?

Once you have completed the FAFSA, you are going to click on “Sign & Submit” and submit the FAFSA to the first 10 schools to which you are applying. After you receive confirmation (approximately 1 to 2 days) that the 10 schools to which you submitted the FAFSA have indeed received the FAFSA, then you will return to the “School Selection” section, “remove” the names of the schools to which you already submitted the FAFSA, and input the names of the remaining schools.

Are all major public and private schools available in the FAFSA?

Yes, practically every accredited four-year college is represented in the FAFSA. Some for-profit colleges and non-traditional programs (e.g. coding boot camps) may not be available.

If the parent is divorced, what information do you need to provide regarding parent number two’s educational level?

If your parents are divorced and there is no relationship to the second parent, then you do not need to provide an answer for parent number two’s educational level or any of the following questions. You can select “other/unknown” as your response.

The parent of one student has a bachelor’s degree from an international college. What response should we provide when asked if a parent has a bachelor’s degree from the U.S.?

Some college applications or supplemental applications within the common application may ask about whether a parent has a bachelor’s degree from a U.S. institution. If a parent received a bachelor’s degree from an international college, then the appropriate response is that the parent does not have a bachelor’s degree from a U.S. institution.

FAFSA questions related to parental educational attainment do not specify U.S. or non-U.S. institutions and are merely asking about the attainment level. The appropriate response would be “college or beyond.” It is appropriate to respond that the parent graduated from college or professional or graduate school as indicated by the degree they received from the international institution that they attended, or indicate “college or beyond.”

Which tax year information is needed for the 2023 – 2024 school year?

You will need to provide the information from the 2021 tax year, which are the taxes you would have submitted prior to April 2022.

If the parents of a student are divorced and one parent is not involved, do you need to report the income of the noncustodial parent? What if both parents are involved?

For the FAFSA, if a student’s parents are divorced and the student resides with only one parent, you will answer questions about the parent with whom the student lived more during the past 12 months. If the student spent equal time with both parents in the past 12 months, then you will respond to questions based on the parent who provided more financial support during the past 12 months. If the selected parent has remarried, then you will have to provide information regarding the stepparent regardless of any prenuptial agreement that may relieve one partner of paying for the education of the other partner’s children.

Tip: For parents who are divorced but on good terms, it is advisable to spend more time during the last year of high school with the parent with less financial strength in order to minimize the expected family contribution.

If our household income varies in 2021 and earnings are higher than normal, where can this context be provided in the FAFSA?

The FAFSA does not provide room for applicants to explain their circumstances. If you need to explain your situation, submit the FAFSA and then send a letter to the financial aid offices of the schools to which you are applying that explains your unique situation. In contrast, if you are applying to schools that are using the CSS profile, you will have the opportunity to explain any special circumstances.

What assets need to be disclosed?

Assets to disclose include money in cash, savings, and checking accounts, businesses, real estate beyond your primary residence, stocks, bonds, certificates of deposit, etc.

Assets that do not need to be disclosed include your primary residence, value of life insurance, and retirement plans.

Do you have to provide bank statements and investment statements as evidence of the asset balances that you report?

Yes. You have to provide supporting documentation and this is typically accomplished through the IDOC system, which is a system to which you will gain access after you submit the FAFSA and the CSS profile.

How is a student’s assets evaluated by the FAFSA?

According to the Federal Student Aid Handbook , student assets are assessed at the rate of 20%. Since parental assets are assessed at the rate of 5%, it is advisable for students to move any income and savings into a parent’s savings or checking account until after submitting the FAFSA.

Related CollegeVine Blog Posts

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Are the 2023-24 FAFSA Requirements?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

When can I update my FAFSA application? The redesigned FAFSA for the 2024-25 academic year is available at FAFSA.gov. Due to major processing delays, you won't be able to make changes to your submitted FAFSA until the first half of April, at the soonest.

You can still submit the 2023-24 FAFSA until June 30, 2024.

All college students attending eligible schools qualify to submit the Free Application for Federal Student Aid, or FAFSA . You're likely to get some kind of aid if you apply, but you may not be eligible for all types. The list of requirements for need-based aid is extensive, and not meeting some can lose you aid eligibility altogether.

» MORE: Your guide to financial aid

Here's what you need to know about FAFSA requirements and aid eligibility.

FAFSA requirements and your eligibility

To be eligible for financial aid, you’ll need to:

Have a high school diploma or a recognized equivalency, such as a GED, or have completed a state-approved home-school high school education.

Be a U.S. citizen or an eligible noncitizen with U.S. national status, or have a green card, an Arrival/Departure Record (I-94), battered immigrant-qualified alien status or a T visa or a parent with a T-1 visa.

Have a valid Social Security number.

Be enrolled or accepted for enrollment in an eligible degree or certificate program.

Maintain satisfactory academic progress in college if you’re already enrolled. Standards for satisfactory academic progress vary by school.

There are no GPA requirements for incoming students. There are also no income requirements for federal loans, but there is for need-based aid like work-study , certain scholarships and the Pell Grant .

» MORE: How much financial aid can I get?

As of the 2021-22 award year, the FAFSA no longer requires Selective Service registration prior to receiving federal financial aid; previously, males between the ages of 18 and 25 who aren't already on active military duty had to register to be eligible for aid.

Additionally individuals who were convicted on drug-related charges while receiving federal aid will not have their aid eligibility suspended. These questions are also no longer on the FAFSA as of the 2023-24 award year.

Why your age (and dependency status) matters for eligibility

Your age may affect how much aid you can receive. That’s because your age largely determines if you’re an independent or dependent student and thus whose information you report on the FAFSA.

Federal aid programs assume dependent students have the financial support of their parents.

» MORE: Am I eligible for financial aid?

By age 24, you’re considered independent. For the 2023-24 school year, you’re independent if you were born before Jan. 1, 2000. Independent students have higher borrowing limits than dependent students.

You’re also considered independent if you’re married, a veteran, in a graduate program or have dependents of your own.

If you’re dependent, include both your and your parents’ information on the FAFSA. If you’re independent, report only your information. If you’re independent and married, include your spouse’s information.

What you need to submit the FAFSA

You'll need to have several documents ready to complete the FAFSA and qualify for aid. If you are an independent student you do not need to include your parents' information. Necessary documents include:

Your Social Security card.

Your driver’s license (if you have one).

You and your parents' 2021 tax returns.

You and your parents' 2021 W-2 forms.

You and your parents' 2021 untaxed income records.

Your parents' current bank statements.

All applicants will need to create an FSA ID that you'll use to sign the FAFSA and promissory notes. This FAFSA checklist gives you all of the information you'll need to fill it out.

On the FAFSA, you'll need to sign a certification statement saying you:

Aren't in default on a federal student loan.

Don’t owe money on a federal student grant.

Agree that all aid will be used for educational purposes only. That includes tuition, fees and room and board.

If you're eligible for aid, accept all free money, such as grants and scholarships, then consider work-study options before taking out any federal student loans.

» MORE: Is college worth it? Use a student loan affordability calculator to find out

How you could lose FAFSA eligibility

You’ll no longer qualify for aid if you can’t meet the basic eligibility requirements listed above. You could also lose eligibility if you:

Don’t maintain satisfactory academic progress in your program, according to your school’s standards. This might include a grade-point average minimum or number of credits completed.

Don’t submit the FAFSA each year you’re enrolled.

Default on a student loan.

Were an eligible noncitizen, but your status expires or is revoked.

A specific type of aid may no longer be available to you if you:

Are no longer enrolled in a program that makes you eligible to receive funding, such as a TEACH grant.

Reach the maximum annual or aggregate lifetime loan limits for unsubsidized or subsidized student loans.

Even if you don’t qualify for more loans, you’ll need to repay any loan you’ve already taken.

On a similar note...

Admissions Essays and Financial Aid

Admissions essays are a key part of your college application. Essays can be challenging to write so here are some tips to help you.

Generally, admissions essays will need to be 650 words or less, depending on the school requirement. Remember to include: why the particular college you’re applying to is a good fit for you, the value you bring to a school, and why this particular college should invest in your education.

Admissions essays can go by different names. Here are some examples of other names:

- Personal Statement

- Personal Essay

- Common App Essay

- Coalition App Essay

- University of California Personal Insight Questions (PIQs)

Colleges can require an admissions essay. These essays can also influence your financial aid package. Many colleges are generous with merit scholarships. A strong essay can boost your application so you secure a spot at a school and get financial aid.

In this guide, you will:

- Learn the types of financial aid that colleges offer

- Learn how the admissions essay impacts merit scholarships

- Start writing your essay

Tip: Your admissions essays do not impact your need-based financial aid.

Types of financial aid

Before we discuss how admissions essays affect financial aid, let’s review the types of financial aid. Your financial aid package may include two award sources: need-based assistance and merit scholarships .

- You will complete the Free Application for Federal Student Aid (FAFSA) to qualify for need-based aid. After your FAFSA form is processed, you will receive a Student Aid Report (SAR) that shows your Student Aid Index (SAI), formerly known as your Expected Family Contribution (EFC) number. Colleges use the SAI to determine the need-based aid that you qualify for.

- Check out DecidED’s FAFSA prep guide for more information on how to apply.

- Not all colleges award merit scholarships. If they do, they may consider your GPA and test scores (if required or reported) when awarding merit scholarships. Many colleges also award merit scholarships for criteria such as high school activities, volunteer service, and demonstrated leadership. Colleges look for you to describe these qualities in your admissions essay.

Who decides financial aid?

On a typical college campus:

- The Office of Financial Aid awards need-based aid using FAFSA and the CSS/Profile, a form used by 400 private colleges.

- Merit scholarship awards mostly come from the Admissions Office after admissions counselors read and debrief your application. Admissions counselors decide on your candidacy and offer any merit scholarships you qualify for based on available dollars and how you compare to other students for the pool of funds.

When you understand the financial aid process from this perspective, you can see why the admissions essay has a lot of impact.

How to boost merit scholarships

A good college essay can also give you a boost if you apply to a college that is ACT/SAT test-optional. Many colleges rely on test scores. Without those scores, your essay is the factor colleges can use to bet on your promise to succeed.

What makes a good essay?

Successful essays read like a memoir or autobiographical sketch. You have had many lived experiences that you can write about. Choose one experience that is relevant to you and go deep. Here are some great admissions essays you can refer to for inspiration and some other good tips and examples .

Tip: The best essays are those that zoom into one, two, or a mosaic of snapshots in time. Find your unique snapshot and write about it.

Express your experiences. Other parts of your college application contain information about your grades, test scores, activities, and coursework. Your essay is the place to write about something personal. As you write, keep digging so positive emotions, such as happiness and hope, are palpable in your essay.

Tip: Before you begin writing about a particular experience, ask yourself: “Why is this important to share?” Each time you answer, you move the reader from a surface-level understanding of your experience to a deeper one. This helps make your essay stand out during admission and merit scholarship decisions.

Tell a clear story. Strong essays have a strong narrative and voice.

- Story-like descriptions make your essay come alive. Show rather than tell directly. Consider yourself the main character in this story. Set up your essay with an attention grabbing beginning, middle, and end.

- Strong essays are entertaining, both for you to write and for your audience to read. Don’t be afraid to explain your emotions, discoveries, and curiosities to show your complex layers and readiness for college-level learning.

Tip: Write a compelling story admissions counselors will want to read from start to finish. A memorable essay can help you win merit scholarship awards.

Show colleges why you’re a great fit. Your essay answers two important questions about you: who you are and why you’re a great fit for a school. Be yourself and focus on telling your story so colleges understand why you’re an ideal candidate for their program. Unlike a Hollywood film, your story doesn’t have an end. Your script is still evolving, and where you spend the next four years will shape your story even more.

This guide is from the team at DecidED, a free tool that can help you compare college costs and other fit factors to make an affordable choice. Take the next step and create a free DecidED account today!

Did this guide help you? Share the knowledge!

Related Guides:

FAFSA and CADAA 101

Get Your Loans on Time

What You Need to Know About Verification

Back To Student Guides

Our Services

College Admissions Counseling

UK University Admissions Counseling

EU University Admissions Counseling

College Athletic Recruitment

Crimson Rise: College Prep for Middle Schoolers

Indigo Research: Online Research Opportunities for High Schoolers

Delta Institute: Work Experience Programs For High Schoolers

Graduate School Admissions Counseling

Private Boarding & Day School Admissions

Online Tutoring

Essay Review

Financial Aid & Merit Scholarships

Our Leaders and Counselors

Our Student Success

Crimson Student Alumni

Our Reviews

Our Scholarships

Careers at Crimson

University Profiles

US College Admissions Calculator

GPA Calculator

Practice Standardized Tests

SAT Practice Test

ACT Practice Tests

Personal Essay Topic Generator

eBooks and Infographics

Crimson YouTube Channel

Summer Apply - Best Summer Programs

Top of the Class Podcast

ACCEPTED! Book by Jamie Beaton

Crimson Global Academy

+1 (646) 419-3178

Go back to all articles

Everything You Need To Know About FAFSA

/f/64062/992x661/c208f7eca6/money-and-education.jpg)

Each year, over 13 million students who file for the FAFSA get more than $120 billion in grants, work-study, and low-interest loans from the U.S. Department of Education. Many states and colleges also use the FAFSA to determine which students get financial aid—and how much they’ll get. Here we highlight who should apply for FAFSA and how to apply.

What is the FAFSA?

The Free Application for Federal Student Aid (FAFSA) is the form you need to fill out to get any need-based financial aid from the federal government to help pay for college. Submitting it is your key to accessing grants, scholarships, work-study programs, and federal student loans. The FAFSA asks for information about you and your family’s financial status and has to be filled out each year you are in college.

What is Need-Based Financial Aid & How Does It Work?

Need-based financial aid is based on your family's financial needs. You'll receive this type of financial aid if you demonstrate the need. When you complete the required financial aid forms (FAFSA and/or CSS Profile), your family's ability to cover college costs is determined, and the result is called the "family contribution.” The "family contribution" is subtracted from your school's fees; the final figure is your demonstrated need. The most familiar type of need-based aid is a grant, but need-based aid can also come from a campus work-study job or a subsidized student loan.

- You can learn more about need-blind vs. need-aware colleges here.

Who Should Fill Out the FAFSA?

The FAFSA is available to all US citizens and permanent residents applying to US universities. Besides that, anyone applying for work-study, other merit-based scholarships, and low-interest loans should also apply for the FAFSA.

How to Fill Out the FAFSA?

You can submit the FAFSA application online , through the StudentAid app, or by mailing the forms.

To submit the online application, you will follow these steps:

- Get a federal student aid ID (FSA ID) for yourself and your parents.

- Collect all the necessary documents .

- Answer all the questions on the application.

- List the colleges to which you want to apply for.

When Should you File the FAFSA?

You can file as early as October 1 for the following academic year. It’s a good idea to apply as soon as possible because financial aid is often given out on a first-come, first-served basis.

There are three types of FAFSA deadlines:

- College deadlines : Check the colleges you are interested in to find individual deadlines, as these vary.

- State deadlines

- Federal deadline : June 30 is the last day you can apply for federal aid for the following academic year.

Top 10 US Colleges That Offer The Most Financial Aid

In addition to government-funded financial aid, many colleges offer private financial aid programs . Utilizing both government and private funding, the following colleges offer the most financial aid:

- Columbia University

- Yale University

- Williams College

- Amherst College

- Harvard University

- Vassar College

- Webb Institute

- Duke University

- University of Chicago

- Colgate University

Can I afford to study in the US?

Top Tips & Advice From Crimson’s Financial Aid Experts

Crimson offers scholarship and FAFSA support to our students. Our dedicated team of financial aid advisors and experts understand the process of financial assistance, can help you with your applications, and answer any questions you may have about financial aid. Our lead advisors sat down with us to answer some of the most common financial aid questions. If you have further questions, please don't hesitate to contact us .

What types of financial aid services does Crimson offer?

We offer three distinct services to Crimson families:

- Financial Aid Review includes three hours of one-on-one time with a Financial Aid consultant. We discuss financial aid strategy, merit scholarships, and review financial aid applications. We also include an additional two hours for email and messaging support.

- Financial Aid Support includes seven hours of one-on-one time with a Financial Aid Consultant to discuss aid strategy, merit scholarships, and assistance with the financial aid application process. We provide an additional two hours for email and messaging support.

- Merit Scholarship Support includes by-the-hour support to research and identify merit scholarship opportunities, support in determining which scholarships to pursue, and financial aid-specific advice through the application process. Please note that this service does not include writing assistance for the merit scholarship applications, which will require support from a Strategist and Application Mentor.

Final Thoughts

Don't let finances limit your college dreams. Take advantage of financial help from the state and federal government, colleges, private organizations, scholarships, and other independent entities. By utilizing all financial aid options, you'll have more opportunities to study at a college that's perfect for you.

Learn how Crimson can help you secure financial support.

What Makes Crimson Different

Key Resources & Further Reading

- Join our free webinars on US university applications

- Free eBooks and guides to help with the college application process

- Crimson Scholarships

- How Financial Aid Works & How To Apply For Financial Aid Explained By Crimson Admission Experts

- Need-Blind vs. Need-Aware Colleges: Which is Best for You?

- How Much Does It Really Cost To Study In The USA?

- US Merit Based Scholarships for International Students

- UK Scholarships For International Students Made Easy

More Articles

College students face uncertainty amid fafsa delays.

/f/64062/500x500/ebdd826148/financial-aid.png)

Navigating Parent Loans: A Guide to Financing Your Child's Education

/f/64062/1169x779/4ba116b8ca/student-loan-medview.png)

The Ultimate Guide to College Grants: How to Find and Apply

/f/64062/1000x665/efa9a5aab0/money.jpg)

US COLLEGE ADMISSIONS CALCULATOR

Find a university that best suits you!

Try it out below to view a list of Colleges.

Enter your score

Enter your SAT or ACT score to discover some schools for you!

How to write a financial need statement for your scholarship application (with examples!)

So you’re applying for a scholarship that asks you about your financial need. What do you say? How honest or specific should you be? What is TMI? In this article, we break down how to pen an awesome financial need scholarship essay or statement.

What to include in a financial need scholarship essay

Template to structure your financial need scholarship essay, introduction: your basic profile, body: your financial situation and hardships, conclusion: how you would benefit from this scholarship, was this financial need essay for a college financial aid application , now, reuse that same essay to apply for more scholarships, additional resources to help you write your financial need scholarship essay.

Many scholarships and college financial aid awards are “need-based,” given to students whose financial situation requires additional support. That’s why one of the most common college scholarship essays is a statement of financial need. This might be very explicit (“Explain your financial need”), somewhat explicit (“Describe your financial situation”), or quite open-ended (“Explain why you need this scholarship”).

In all cases, scholarship providers want to get a sense of your family’s financial picture: what your family income is, if you personally contribute to it (do you have a job?), and how much additional money you need to attend your target college (your “financial gap”).

If the essay prompt is a bit more open-ended (“Explain how this scholarship would help you”), your essay should probably be a combination of a financial need statement and a career goals / academic goals essay. That’s because you want to show how the award will help you financially and in your academic or career goals.

Usually this statement of financial need is a pretty short scholarship essay (150-300 words), so unlike a college essay or personal statement where you have ample word count to tell anecdotes, you’ll likely need to get right to the point.

Be sure to include:

- If you are an underrepresented group at college, for instance, part of an ethnic minority or the first in your family to go to college

- Any relevant family circumstances, like if your parents are immigrants or refugees, as well as your parents’ occupation and how many children/family members they support financially

- How you are currently paying for college, including what you personally are doing to contribute financially (like working student jobs)

- What financial challenges/difficulties your family is facing, for instance, if a parent recently lost their job

- How you would benefit from the scholarship–including your academic and career goals (if word count allows)

Also remember to write in an optimistic tone. Writing about your financial situation or hardships might not be the most positive thing to share. But you can turn it around with an optimistic tone by writing about how these challenges have taught you resiliency and grit.

Give a short introduction to who you are, highlighting any family characteristics that might make you part of an underrepresented group at college.

“I am a first-generation American and the first in my family to go to college. My family moved from El Salvador to New York when I was seven years old, to escape the violence there.”

Example 2:

“I am from a working-class family in Minnesota. My family never had a lot, but we pooled our efforts together to make ends meet. My parents both worked full-time (my father as a mechanic, my mother as a receptionist at the local gym), while my siblings and I all worked weekend jobs to contribute to the family income.”

Dive into the details. How are you currently planning to pay for college? The idea here is to show that you and your family have made a good-faith effort to earn enough money to pay your tuition, but that it has simply not been enough.

Make sure you describe your parents’ occupation, any savings (like a 529 College Savings Account), and any student jobs. You might also discuss any sudden changes in fortune (e.g. parent fell ill or lost their job) that have ruined your original financial plans.

Example

As immigrants with limited English, my parents have had to accept low-paying jobs. My father is an Uber driver, and my mother is a housekeeper. They earn just enough to pay our rent and put food on the table, so I’ve always known they could not help me pay for college. So I’ve been proactive about earning and saving my own money. Since age 11, I’ve worked odd jobs (like mowing my neighbors’ lawns). At age 16, I started working at the mall after school and on weekends. Through all these jobs, I’ve saved about $3000. But even with my financial aid grants, I need to pay $8000 more per year to go to college.

Bring it home by wrapping up your story. Explain how you plan to use the financial aid if you’re awarded this scholarship. How will you benefit from this award? What will you put the money toward, and how will it help you achieve your academic and/or career goals?

Scholarship review boards want to know that their money will be put to good use, supporting a student who has clear plans for the future, and the motivation and determination to make those plans a reality. This is like a shortened, one-paragraph version of the “Why do you deserve this scholarship?” essay .

Winning $5000 would help me close the financial gap and take less in student loans. This is particularly important for me because I plan to study social work and eventually work in a role to support my community. However, since these jobs are not well paid, repaying significant student loans would be difficult. Your scholarship would allow me to continue down this path, to eventually support my community, without incurring debt I can’t afford.

My plan is to study human biology at UC San Diego, where I have been admitted, and eventually pursue a career as a Nurse-Practitioner. I know that being pre-med will be a real academic challenge, and this scholarship would help me focus on those tough classes, rather than worrying about how to pay for them. The $2000 award would be equivalent to about 150 hours of working at a student job. That’s 150 hours I can instead focus on studying, graduating, and achieving my goals.

Sometimes this financial need statement isn’t for an external scholarship. Instead, it’s for your college financial aid office.

In that case, you’re usually writing this statement for one of two reasons:

- You’re writing an appeal letter , to request additional financial aid, after your original financial aid offer wasn’t enough. In this case, you’ll want to make sure you’re being extra specific about your finances.

- You’re applying for a specific endowed scholarship that considers financial need. In this case, your financial need essay can be quite similar to what we’ve outlined above.

Now that you’ve written a killer financial need scholarship essay, you have one of the most common scholarship essays ready on hand, to submit to other scholarships too.

You can sign up for a free Going Merry account today to get a personalized list of hundreds of scholarships matched to your profile. You can even save essays (like this one!) to reuse in more than one application.

You might also be interested in these other blog posts related to essay writing:

- What’s the right scholarship essay format and structure?

- How to write a winning scholarship essay about your academic goals

- How to write an awesome essay about your career goals

- Recent Posts

- Scholarships for Students in Pennsylvania for 2021 - November 11, 2020

- Counselor Starter Guide: How to Use Going Merry’s Scholarship Platform - September 9, 2020

- How to write a financial need statement for your scholarship application (with examples!) - August 13, 2020

Ready to find scholarships that are a match for you?

- How to Write the Perfect Financial Aid Suspension Appeal Letter (and a Sample)

- Financial Aid

Your financial aid can be suspended while you attend school for several reasons: You switch schools or change majors; your family makes too much money, which changes the information on your Free Application for Federal Student Aid (FAFSA); or you do not make satisfactory academic progress (SAP) as determined by your school.

If your school suspends your financial aid, and private student loans are not an option, it makes sense to worry about completing your degree. Depending on the reasons your aid was suspended , you can likely file an appeal.

If you do not meet the minimum course or hour requirements, you may lose financial aid with no ability to appeal. However, if you have personal reasons for struggling academically during the school year, you can file an appeal.

As part of your financial aid suspension appeal, include a letter explaining what happened. This letter can help the committee determine whether to reinstate this help.

- How to Understand the Appeals Process During Financial Aid Suspension

Filing a financial aid suspension appeal starts when you go to your school’s student financial services office. Ask them about the appeals process and what forms you need. Be diligent about gathering correct information and file your appeal by the deadline. Schools generally only allow you to file an appeal when your financial aid is suspended due to an SAP problem. To have financial aid reinstated, you must:

- Understand your school’s SAP auditing process and the specific causes for your financial aid’s suspension.

- Show that you have corrected the SAP problem.

- Submit the appeal.

- Have your appeal accepted by the SAP committee.

When your appeal is accepted, you will be placed on financial aid probation. This provides you another semester, trimester, or quarter of financial aid. The committee will then reconvene to determine whether you addressed your SAP problem in a satisfactory way. A successful SAP appeal will include information about why your academic status changed, you dropped courses or failed to sign up for enough courses, or otherwise did not meet your school’s standards. There are many reasons students struggle, but some common causes include:

- Personal struggles with physical or mental health

- Family struggles, including illness or death

- Financial catastrophe, making your living situation unstable

As you complete your SAP appeal , gather information like health records, financial records, family statements, and correspondence with professors, employers, and peers that may be relevant. You should also write a personal letter to the SAP committee, which acknowledges that you did not meet SAP standards, that you understand what happened, and that you will take steps to correct this problem. Components of a successful SAP appeal letter are :

- Formal heading, including your name, student identification, the date, and the committee’s information

- Formal address, including names of committee members you have corresponded with

- Introductory and concluding paragraphs

- One or two paragraphs explaining events that caused your academic struggles

- Information in these middle paragraphs about how you will improve your performance in the coming semester, trimester, quarter, or year

- Formal signoff

- Information about relevant attachments, like doctors’ notes or personal statements from family members

You may also be required to create a plan, in a separate document, to improve your academic performance. If you have a good academic record from previous years, you can show that this is a temporary problem and you understand how to solve it. If you are a newer student, you may need to provide references from other school years or classes that show you are able to improve your performance.

- Financial Aid Suspension Appeal Letter Sample

To understand how all the components of a financial aid suspension appeal letter work together, here is a sample: Dear Dr. Smythe and Esteemed Members of the Committee, My name is Joan Doe, and I am writing this letter as part of my appeal to reinstate my financial aid. Because I struggled to complete classes during this past semester, it was determined that I did not make satisfactory academic progress per the institution’s guidelines. Consequently, my financial aid was revoked. While I respect the school’s decision regarding my grades, I need this financial support to continue completing my bachelor’s degree. My poor academic progress occurred because of struggles within my family this year. My father was diagnosed with colorectal cancer. While his prognosis is good and we now know that treatment is going well, it was a devastating emotional blow. I spent more time with my family, helping to take care of the household and my two younger siblings while my mother was with my father during his treatment. This included a hospital stay of about one week, during which time I was unable to return to class. I worked hard on my studies during this time, but because my time was much more limited, I was unable to focus on writing papers, studying for midterms and finals, and meeting some deadlines. My professors, including my adviser Dr. Smythe, have been as understanding as possible. I did not communicate as clearly as I should have, and I understand that my negligence has translated into lower grades. I even failed some courses, which is a first for me, if you look at my previous years at this college. I regret such poor performance, and I want to improve in the coming academic year. The school has accepted me as a student again for the upcoming semester, but without the financial aid provided through the Pell Grant and student loan programs, I cannot afford to attend. My academic record prior to this has been exceptional, and I believe I can return to this level of scholastic performance. Please consider reinstating my financial aid with my regret, my apologies, and my history as a good student in mind. Thank you for your consideration. I appreciate attending this school and look forward to graduation. Respectfully, Joan Doe

- Other Sources of Funding if Your Financial Aid Is Suspended

The SAP committee may not accept your appeal or your financial aid suspension could stem from other causes, like changing majors and no longer meeting scholarship requirements. Other sources of financial aid, like private student loans, can help you complete your semester or year if you are unable to get your financial aid reinstated.

Table of contents

Related articles.

Where to Find the Best Scholarships for College Freshmen

Learn about scholarship opportunities for college freshmen and where you can find them.

How to Apply for College Scholarships

College scholarships can help reduce educational expenses. Learn how to find college scholarships and get tips for submitting a winning application.

The Best College Scholarships for High School Students

Here are some of the best college scholarships for high school students and where you can find more helpful resources regarding college finances.

- Search All Scholarships

- Exclusive Scholarships

- Easy Scholarships to Apply For

- No Essay Scholarships

- Scholarships for HS Juniors

- Scholarships for HS Seniors

- Scholarships for College Students

- Scholarships for Grad Students

- Scholarships for Women

- Scholarships for Black Students

- Scholarships

- Student Loans

- College Admissions

- Financial Aid

- Scholarship Winners

- Scholarship Providers

Student-centric advice and objective recommendations

Higher education has never been more confusing or expensive. Our goal is to help you navigate the very big decisions related to higher ed with objective information and expert advice. Each piece of content on the site is original, based on extensive research, and reviewed by multiple editors, including a subject matter expert. This ensures that all of our content is up-to-date, useful, accurate, and thorough.

Our reviews and recommendations are based on extensive research, testing, and feedback. We may receive commission from links on our website, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted. You can find a complete list of our partners here .

How to Write a Financial Aid Appeal Letter (With Example)

Will Geiger is the co-founder of Scholarships360 and has a decade of experience in college admissions and financial aid. He is a former Senior Assistant Director of Admissions at Kenyon College where he personally reviewed 10,000 admissions applications and essays. Will also managed the Kenyon College merit scholarship program and served on the financial aid appeals committee. He has also worked as an Associate Director of College Counseling at a high school in New Haven, Connecticut. Will earned his master’s in education from the University of Pennsylvania and received his undergraduate degree in history from Wake Forest University.

Learn about our editorial policies

Bill Jack has over a decade of experience in college admissions and financial aid. Since 2008, he has worked at Colby College, Wesleyan University, University of Maine at Farmington, and Bates College.

Maria Geiger is Director of Content at Scholarships360. She is a former online educational technology instructor and adjunct writing instructor. In addition to education reform, Maria’s interests include viewpoint diversity, blended/flipped learning, digital communication, and integrating media/web tools into the curriculum to better facilitate student engagement. Maria earned both a B.A. and an M.A. in English Literature from Monmouth University, an M. Ed. in Education from Monmouth University, and a Virtual Online Teaching Certificate (VOLT) from the University of Pennsylvania.

Let’s say you get accepted to college, but the financial aid package does not work for you and your family. Did you know that many colleges will allow you to submit a financial aid appeal letter to be considered for more financial aid and scholarships?

When I worked in college admissions, I was a part of our college’s “scholarship appeal committee” where I helped evaluate various appeals for more financial aid and merit scholarships.

Related: Scholarships360’s free scholarship search tool

Jump ahead to:

Starting the merit scholarship appeal process

How to write your merit appeal letter, how to appeal for need-based financial aid.

- Financial Aid Appeal Example

Can you ask for more money from private scholarships?

- What can you do the college turns down your appeal?

Feel free to jump ahead to any of the above sections or keep on reading to learn more about the appeals process. Students should also thoroughly review their financial aid award letter to understand what types of aid the college offered them.

Recommended: How to read a financial aid award letter (with examples)

Before you begin thinking about the merit scholarship appeal process, you should make sure that the college or university actually offers merit scholarships. If the institution does not offer merit scholarships, this is a nonstarter (a quick review of their admissions and financial aid website should tell you whether they do).

Once you know that the college does offer merit scholarships, you can inquire about the merit scholarship appeal process and whether they offer it. You can either call the admissions office or email the admissions officer responsible for your region. If they say that there is a process, you can start working on your appeal letter.

Related: How to get student rent assistance

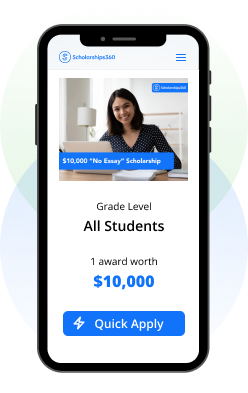

Apply to these scholarships due soon

$10,000 “No Essay” Scholarship

$2,000 Sallie Mae Scholarship

“Get Inspired” TikTok Scholarship

Niche $25,000 “No Essay” Scholarship

SKECHERS Financial Hardship Scholarship

$25k “Be Bold” No-Essay Scholarship

SKECHERS Academic Excellence Scholarship

SKECHERS Athletic Performance Scholarship

$2,000 No Essay CollegeVine Scholarship

First things first, let’s talk about how you can write a successful merit appeal letter. A successful letter is all about making your case to the admissions officer.

Here is our step-by-step process for writing a merit appeal letter:

- Begin your letter by introducing yourself, where you are from, and your high school.

- You should also reiterate how grateful you are to be admitted to the college and how excited you are to potentially attend.

- Next explain the reasons why you are appealing for money in scholarships–did you receive need-based financial aid? Perhaps you did not receive enough need-based financial aid? Or maybe there was a life circumstance that’s making paying for college difficult for your family? If so, provide a brief explanation.

- Have you accomplished anything significant academically/extracurricularly since you applied? This would be a good time to mention that. Same goes for any new grades/test scores.

- Do you have more generous merit scholarship offers from other schools? Include the offer letters along with your note. While this may seem a bit crass, it helps give the admissions office context of where you are coming from.

- Finally, you should conclude the letter by thanking the admissions officer for their time and consideration. You can also restate your interest in the college and why you hope to attend.

Related: Why didn’t I receive financial aid?

Need-based financial aid is a completely different type of financial aid than merit aid. Colleges award need-based scholarships according to a formula dictated by your family’s financial situation. This means that there is very little (if any) wiggle room for how colleges award need-based financial aid.

With this said, there are two ways that you may be able to receive a reevaluated need-based financial aid package:

- There was an error on your FAFSA or other financial aid form (like the CSS Profile )

- Your family’s financial aid situation has changed since you submitted your financial aid forms. Two of the most common reasons that this can happen include dramatically increased medical expenses or a parent loses their job. However, there may be other situations that could impact a family’s financial situation.

In these situations it is absolutely worth contacting the college’s financial aid office to ask if there is any possibility of an adjusted aid package. Generally, the office of financial aid will ask you for a letter explaining your change in circumstances, with context and possible documentation.

Is there any harm to appealing for more financial aid?

When a need-based financial aid appeal is filed, the financial aid officers will examine the entire financial aid application again. In this second, careful review, it is possible that the financial aid officers might see something that could cause the award letter to change for the worse. While this is rare, it is important to know that financial aid appeals can impact your financial aid positively and negatively.

Advice from an admissions professional

Christina labella.

Director of Undergraduate Admissions

Manhattanville University

Financial aid appeal letter sample

Below you will find a financial aid appeal letter sample that you can use as an outline when writing your own appeal letter.

Dear [Ms. Gomez],

My name is [Will Geiger] and I am a senior at [Manasquan High School] in [Manasquan, NJ]. I was so excited to be accepted to [Wake Forest University] as a member of the class of [2024].

However, as I weigh my college options, affordability is an important factor for me. [Wake Forest University] is a top choice college for me. [Include 2-3 reasons why the college is a good fit].

I am writing to ask to be considered for any merit scholarship opportunities. [Include 2-3 academic or extracurricular updates from this year].

I have been lucky enough to receive the following scholarships from some other colleges:

[Specific colleges and award amounts]

Additionally, I have attached the actual award amounts.

Nonetheless, I want to attend [Wake Forest University] to study [insert major] and can’t wait to study [insert details about specific classes, programs, or professors that you hope to experience at the college]. With my [insert major] degree, I want to go into [insert job or ambition].

Thank you for the opportunity to be reconsidered for additional merit scholarship opportunities. I am honored to be accepted at [Wake Forest University] and hope to be a member of the freshman class.

Please let me know if you have any other questions!

Will Geiger

Private scholarships are almost always awarding a very fixed amount of money so it is unlikely that they are going to be considering appeals. This is unlikely to be a winning strategy for students. Of course, with billions of dollars in scholarship money available each year, nothing should stop you from finding and winning more scholarships!

What can you do if your appeal is turned down?

Once you have exhausted the appeals process and have determined that your financial aid forms accurately represent your family’s financial situation your next best move is to apply for more scholarships and consider more affordable options on your list.

There are still many scholarships available for current high school seniors . Additionally, you should continue to apply for scholarships once you are in college (there are a number of scholarships available for college freshmen ).

In addition to scholarships, you may also qualify for federal work study , which is essentially a part time job to help pay for educational expenses.

If your financial situation simply won’t permit you to accept the college’s offer, there are many other options available . Coding bootcamps , certificate programs , and community college can all help you land a higher-paying job. These alternatives typically take a fraction of the time and cost of traditional college.

Finally, student loans or Income Share Agreements can be a last resort for paying for college. Students should consider all of their federal student loan options before considering any private student loans.

Recommended: How to apply for student loans

Key Takeaways

- Being accepted by a college means they want you to join their institution

- As a result, they may be open to considering you for additional merit scholarships

- Taking an hour to negotiate merit scholarship aid could result in thousands of dollars in scholarships down the line

- Financial aid appeals will not result in your admission being rescinded

Frequently asked questions about financial aid appeal letters

Will a college rescind my admission if i ask for more financial aid, could i lose my financial aid if i file a financial aid appeal, how do i ask for more financial aid from a college, what if i can't afford my financial aid package, what are some valid reasons for a financial aid appeal.

- A significant change in your family’s financial situation

- Recent unemployment

- High medical related expenses

- Changes in family size or dependency status

- Other extenuating circumstances

How long does it take to receive a response to a financial aid appeal letter?

Apply to vetted scholarship programs in one click

Scholarships360 recommended.

Top 64 No Essay Scholarships in April 2024

Top 244 Scholarships for High School Juniors in April 2024

$20k in Exclusive Scholarships from Scholarships360

Trending now.

Top 49 Easy Scholarships✅ to Apply For in April 2024

Top 1,282 Scholarships for High School Seniors in April 2024

Top Scholarships for Current College Students in April 2024

3 reasons to join scholarships360.

- Automatic entry to our $10,000 No-Essay Scholarship

- Personalized matching to thousands of vetted scholarships

- Quick apply for scholarships exclusive to our platform

By the way...Scholarships360 is 100% free!

Frequently Asked Questions

Eligibility requirements , q: what should i do to be ready to apply for a pamplin scholarships.

- Students applying for scholarships must file FAFSA prior to the on-line Scholarship Application deadline.

- Update Hokie-Spa and major(s)/minor(s) information and expected graduation date! Avoid becoming ineligible for scholarships by updating your record! Check all contact information, anticipated graduation date, and major(s)/minor(s) etc. Most scholarships have specific restrictions in the criteria that must be verified against the student record.

- Review the Scholarship List on Scholarship Central’s Site to determine your eligibility for our current individual scholarships. Read the scholarship qualifications very carefully so that you do not apply for scholarships for which you are not eligible.

- Update your resume and create an individual essay for each intended scholarship application. Each applicant will submit one resume and then will submit one essay per scholarship (1 page, maximum file size 250k). Save each document separately so that you may upload them individually when you apply.

Q: I was just admitted to Virginia Tech in the Pamplin College of Business, can I apply for these scholarships?

No, the online Scholarship Application is for the purposes of students who are currently enrolled at Virginia Tech (completed at least one semester at VT), with a declared major in the Pamplin College of Business (Bus Undecided, ACIS, BIT, ECON, FIN, HTM, MGT, or MKTG). Check back here next year to find out how to apply for the college-level scholarships.

Q: Is there a minimum GPA for your scholarships?

Some scholarships mention specific GPA requirements. For those that do not, recipients generally have an overall GPA of 3.4 or higher, but that can vary depending upon the applicant pool.

FAFSA Information

Q: if i already have a fafsa on file, do i need to submit another one each year.

Yes, because recipients will receive their scholarships in the same academic year.

Q: If I do not need financial aid and I am not planning to apply for a scholarship, am I required to file a FAFSA?

No, you are not.

Q: How do I apply for a FAFSA?

Go to the Financial Aid and Scholarships website for general information, helpful hints, FAFSA4caster, frequently asked questions, and a link to apply for the FAFSA on-line. The FAFSA is available for completion prior to the upcoming aid year, and must be submitted (with valid signatures) by Virginia Tech’s deadline. However, for Pamplin Scholarships you may file up till the Pamplin Deadline.

Q: I have not filed my tax return yet, so how can I complete the FAFSA?

- Starting with the Free Application for Federal Student Aid (FAFSA®), the following changes have been put in place:

- Students are now able to submit a FAFSA as early as Oct. 1 every year.

- Students now report earlier income information. Beginning with the 2017–18 FAFSA, students are required to report income information from an earlier tax year. For example, on the 2017–18 FAFSA, students (and parents, as appropriate) must report their 2015 income information, rather than their 2016 income information.

Q: I filed my FAFSA, but have outstanding signatures and/or paperwork to complete for the Financial Aid Office, am I still eligible for the scholarship(s) I applied for online?

Yes and no. Yes, if you applied for scholarships that are not need-based. No, if you applied for a need-based scholarship. You MUST have a “complete” FAFSA by the Pamplin deadline to be eligible for need-based scholarships. If you submit your FAFSA and application by the deadline, but have outstanding paperwork or signatures to finalize your submission, your application cannot adequately be reviewed. Therefore, your application will not be considered. If you are aware of any problems that cannot be resolved by January 15th, you must contact Fin Aid or prior to the deadline and an exception may be possible.

Q: I am an International student, can I still apply for scholarships since I cannot file a FAFSA?

Yes. A FAFSA is required for non-need-based scholarships. However, for a need-based scholarship, International students are required to click here to complete a College Board Expected Family Contribution (EFC) Calculator . After completion, submit a copy of the estimate printout to Matt Hammond in the VT Office of Scholarships and Financial Aid. The document can be submitted in person at 200 Student Services Building; by fax to 540.231.9139; or, by e-mail/scanned document to [email protected] . Important: Identify on the document that it is to be used for Pamplin Scholarship application purposes.

Applying for Scholarships

Q: i filed my fafsa and updated all of my information, how do i apply for scholarships.

Go to the Scholarships page on the Pamplin Undergraduate Programs website to apply online. (No paper applications will be accepted).

Q: What scholarships are available this year?

Please do not wait for an offer of admissions before applying for scholarships. Apply Now! The application process and deadline will vary depending on who is awarding the scholarship. Click on the various types of scholarships for more information.

Q: How do I know if I am eligible for the college-level scholarships?

Compare your qualifications with the eligibility requirements listed for each scholarship. If eligible, you may apply for one or more. Please note that while students may apply for multiple scholarships, it is uncommon to receive more than one award.

Q: What is a “need-based” scholarship, and am I eligible to apply for it?

ALL need-based scholarships will be awarded ONLY to those students with financial-need, as determined by results from the FAFSA. You may use the FAFSA 4Caster to get a general estimate of your eligibility, but a FAFSA must be completed by the Pamplin deadline.

Q: I am a sophomore now, but will be a junior by the end of the spring semester. How do I determine my class level when considering scholarship qualifications?

To properly award scholarships, a student’s class level is not determined by credits, but by an estimated expected date of completion. When considering your eligibility related to class level, use the following guide:

If you plan to graduate in: December 2019, May 2020, or Summer 2020 = “rising sophomore” December 2018, May 2019, or Summer 2019 = “rising junior” December 2017, May 2018, or Summer 2018 =“rising senior” *The chart above still applies to scholarships that do not state the word “rising”, followed by sophomore, junior, or senior.

Q: I am preparing to write my essay for a scholarship, what should I include?

Compare your qualifications with the criteria listed after each scholarship. After selecting the scholarship for which you will apply, write an essay highlighting those qualities to support why you are the most qualified candidate. Please note that if you apply for multiple scholarships, do not submit a general essay. Each essay will be reviewed and must be unique!

Q: What do I do if I am having trouble uploading my resume and essay(s) to the online Scholarship Application?

Check the file size to be sure each document does not exceed 250k, and then try to upload again.

Q: I already submitted an online Scholarship Application, but would like to apply for more scholarships. Is it too late?

No, it is not too late to apply for more scholarships as long as the application is complete prior to the Pamplin deadline. Log back in and “Un-Submit the Application”, and then follow each step as you did before. Be sure to complete and re-submit the application before logging out. Incomplete applications will not be eligible for consideration.

Q: I completed the online Scholarship Application, but how do I know if it has been received?

If you successfully submitted your application with the proper attachments, the last page will state “Application Complete”. You do not need to do anything else. Undergraduate Programs will contact applicants if there is a problem with submission. Otherwise, all applicants will be notified of their application status no later than mid-May.

Award Notification

Q: when will i be notified if i am a scholarship recipient.

Depending on the scholarship, recipients will be notified between March and May.

Q: If I receive a scholarship, will I be recognized at the Annual Honors Banquet and receive my scholarship?

The Annual Honors Banquet will be held in the early fall. In addition to your notification letter, a formal invitation will be sent to you over the summer with the banquet details. Awards are deposited into student accounts, and distributed over the academic year (unless otherwise noted in the award letter).

Q: If I receive a scholarship, do I have to attend the Annual Honors Banquet?

Yes, recipients are required to attend. Scholarship donors are invited, so you may have the opportunity to thank your donor in person! It is a very nice event that celebrates the achievements of Pamplin students and the generosity of the donors.

Yes, FAFSA delays are a mess, but college students need to file to get their financial aid

By working together, we can ensure that the fafsa remains a reliable and accessible tool for tennessee students seeking to realize their academic ambitions..

- Steven Gentile is executive director of the Tennessee Higher Education Commission.

- Krissy DeAlejandro is president/CEO of tnAchieves.

- Burton Williams is Chief Executive Officer of The Ayers Foundation Trust.

As we navigate the ever-evolving landscape of higher education, one thing remains constant: the critical importance of financial aid.

Central to this aid lies the Free Application for Federal Student Aid (FAFSA) , a lifeline for Tennessee students who are pursuing their academic dreams. However, this year has seen extraordinary delays in FAFSA processing , complicating the aspirations of countless students.

As partnering organizations for the Tennessee Promise, the Tennessee Higher Education Commission (THEC), the Ayers Foundation Trust, and tnAchieves are deeply concerned about the implications of these delays and the ultimate effect they will have on our students.

Together, we encourage all students, either first-time college students or those wishing to return and complete their degree, to complete the FAFSA as soon as possible. For those wanting to remain eligible for Tennessee Promise, the deadline to submit the 2024-2025 FAFSA is May 15, 2024.

Another view: Is college worth the time and money? Facts, job opportunities and income potential say yes

Many Tennessee families have yet to complete the FAFSA

The FAFSA is the application used by current and prospective college students to determine eligibility for both federal and state financial aid, including Tennessee Promise and Tennessee Reconnect . For many years, Tennessee has been a national leader in FAFSA completion, often ranking as the top state in the country for FAFSA submissions.

However, the U.S. Department of Education’s efforts to simplify the FAFSA have resulted in nationwide delays in the opening of the application period and processing of applications. Unfortunately, these delays in FAFSA processing are complicating the already stressful journey of applying for financial aid. While preliminary data indicate Tennessee continues to lead the country in FAFSA completion among high school seniors, we know many students and families have yet to take this important step in the college-going process.

One of THEC, tnAchieves, and the Ayers Foundation Trust’s main responsibilities is coordinating with high schools and colleges to ensure students are prepared for their next steps. We’ve increased those efforts in recent months to raise awareness of these issues through targeted communications to all prior-year FAFSA filers, monthly FAFSA update webinars for school and community partners, weekly webinars for families completing the 2024-25 FAFSA, and local, in-person FAFSA workshops.

Another view: We Tennessee public university presidents all want citizens to get a four-year degree

You will still be eligible for financial aid in the 2024-25 school year

To the students and families affected by this year's FAFSA delays, it is not too late to complete this important step. We assure you that the financial aid you are eligible for will be there when you finish the FAFSA.

We are also here to help. It’s our job to ensure you never feel alone on this journey. Students can access the 2024-2025 FAFSA at https://studentaid.gov . If you have questions along the way, we are here to help. Call the THEC FAFSA Hotline at 1-800-342-1663 for FAFSA completion assistance.

To Tennessee policymakers, education leaders, and higher education advocates, by working together, we can ensure that the FAFSA remains a reliable and accessible tool for students seeking to realize their academic ambitions. To augment our efforts, we respectfully request that you reach out to your community education leaders and encourage their support of our enhanced FAFSA completion work.

Completing the FAFSA is the first step in the pursuit of a degree or credential. By completing this critical process, students are one step closer to pursing their dreams of a college education, allowing them to get their foot in the door for the career, and future, that they want.

Steven Gentile is executive director of the Tennessee Higher Education Commission .

Krissy DeAlejandro is president/CEO of tnAchieves .

Burton Williams is Chief Executive Officer of The Ayers Foundation Trust .

- Side Hustles

- Power Players

- Young Success

- Save and Invest

- Become Debt-Free

- Land the Job

- Closing the Gap

- Science of Success

- Pop Culture and Media

- Psychology and Relationships

- Health and Wellness

- Real Estate

- Most Popular

Related Stories

- Earn New FAFSA rollout has faced several obstacles and delays—what students can do

- Become Debt-Free Some student loan borrowers will start seeing their debt forgiven in February

- Earn Tax pro shares how to do your taxes and why they don't teach you in school

- Save and Invest Why it's smart to build a 'me fund,' according to a CFP

- Spend 3 tax rules weren't a big deal last year—now they could cost you thousands

FAFSA is still having major issues and delaying financial aid decisions—how students and families can cope

Numerous hiccups in the rollout of the updated Free Application for Federal Student Aid have upended this year's financial aid award season .

Technological issues during the soft launch of the application at the end of December meant many students and their families may have struggled just to submit the form from the time of its release through mid-January.

Over 17 million people submit FAFSAs each year, per Department of Education data . But this year, as of late March, FAFSA submissions were down about 29% from the previous year, according to the National College Attainment Network . By now, most of the problems with submitting the form have been resolved, but getting the FAFSA information from the ED's Federal Student Aid office to colleges has introduced another slew of issues.

At the end of March, FSA identified problems with the information some schools were receiving, including inconsistent student tax information from the Internal Revenue Service that could impact a student's aid eligibility. The errors impacted an estimated 5% of processed FAFSA, according to ED and the IRS, all of which will be reprocessed in the first half of April, the department said in a blog post.

Many of those who have filled out an application are waiting in limbo to find out how much they will owe for tuition for the upcoming school year.

"Every day matters, and with hundreds of thousands of FAFSAs needing to be reprocessed, even more delays for students are coming," Justin Draeger, president and CEO of the National Association of Student Financial Aid Administrators said in a statement . "Continually taking two steps forward and one giant step back is not a sustainable pathway toward getting financial aid offers out to students and families."

While you may have to wait some time until you get your aid package, it's still advisable to submit your FAFSA as soon as you can. Outside of those erroneous forms being reprocessed, FSA said as of April, schools should start receiving students' financial information within one to three business days of the student submitting their FAFSA.

Typically, most colleges have a May 1 deadline for incoming students to commit to attending, but many schools have pushed that date back in light of the FAFSA delays. Still, some students may feel the pressure to commit to a school before they've seen all the financial aid offers available to them or skip the FAFSA — and potentially college — process altogether.

Here are a few things to keep in mind if you're stressed about making a college decision amid the FAFSA turmoil.

Patience and communication are key

It's important for students who need financial aid to pay for college — and even those who think they may not qualify for aid — to complete the FAFSA, higher education experts say.

Despite the delays, "Every high school senior and returning college student should still be completing the FAFSA," Bethany Hubert, a financial aid specialist at Going Merry by Earnest , tells CNBC Make It. "Especially those low-income, minority and first-generation students that can really benefit from this financial aid — they need to make sure they're prioritizing it."

Once you've completed your application, Hubert says all you can really do after that is keep an eye on institution commitment deadlines, be patient and communicate your situation to the appropriate parties —schools awaiting your decision or the FSA office in the event of errors on your FAFSA.

"Make sure that you're being proactive and staying on top of communication from your financial aid office and the Department of Education," she says. "And make sure if you know that you're going to have to do an appeal or a FAFSA correction that you're prepared for that as well."

Make an informed decision

Hubert stresses, however, that you shouldn't feel pressured to commit to a school you don't know you can afford just because the deadline is approaching and you haven't seen your aid package.

"Make sure that you're not committing if you're uncomfortable [with your aid package] or without having all the information in front of you," she says. "If you can wait for those decision deadlines, try and do that so that you can get those award letters hopefully in time to make an informed decision."

Students who have received aid packages they feel are smaller than anticipated may consider appealing that decision with their school's financial aid office, Hubert says. If your student aid index — a number generated by the FAFSA which your college will use to help determine your aid eligibility — feels off, you'll definitely want to ask them to take another look.

Additionally, if something in your family's financial circumstances isn't reflected in your FAFSA, like a recent decline in income or caring for an elderly family member, informing your prospective school's financial aid office of those could help you get more need-based aid, Hubert says.

If you're really in a bind waiting for a financial aid decision, Hubert recommends considering alternate pathways, such as enrolling in community college to help lower the overall cost of your education. Getting a college degree typically pays off in the long run in terms of the jobs you'll be able to get and salary you'll be able to command with a bachelor's versus without.

"You shouldn't just jump to skipping college altogether," Hubert says. She mentions a few small ways you might be able to reduce your cost of attendance like looking for more affordable housing or changing your meal plan.

"There's lots of ways to kind of nickel and dime some savings out of college," she says.

Want to make extra money outside of your day job? Sign up for CNBC's new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. Register today and save 50% with discount code EARLYBIRD.

Plus, sign up for CNBC Make It's newsletter to get tips and tricks for success at work, with money and in life.

- Skip to main content

- Keyboard shortcuts for audio player

This year, colleges must choose between fast financial aid offers, or accurate ones

Sequoia Carrillo

Countless prospective college students are eager to commit to colleges, acceptances in hand, but are stuck waiting for one last piece of the puzzle: their college financial aid package. Those offers are coming later than normal this year, due to the troubled launch of the U.S. Education Department's new federal student aid form, or FAFSA.

Some institutions are doing anything they can to get those offers out as soon as possible – even if it means they aren't a guarantee. For example, Cal Poly Pomona has decided to send "provisional" aid offers for now, with final offers coming by the time students officially start classes.

This year it's a slow crawl to financial aid packages for students

"The goal is to have these done, you know, for sure before school starts," says Jeanette Phillips, head of financial aid there. Phillips says other financial aid administrators in the California State University system, the largest in the country, have decided to do the same thing.

With students and families eagerly awaiting the results of their FAFSA applications, college financial aid offices are in a tough position: They need to send aid offers out as soon as possible to give students time to weigh their options, but they also don't yet trust the FAFSA data the Education Department is sending them.

That's because the data has been "riddled with errors or incompletions," says Justin Draeger, the president and CEO of the National Association of Student Financial Aid Administrators.

To navigate this dilemma, Draeger says, "different schools are trying different tactics."

"Some schools are going to send out provisional or estimated aid offers as soon as they can. Other schools aren't able to sort through the data. They feel like they are stuck until they get more information."

At Oregon State University, the financial aid office is taking its time. Keith Raab, the head of financial aid at OSU, tells NPR they've had the conversation about provisional offers, but ultimately decided against it.

Exclusive: The Education Department says it will fix its $1.8 billion FAFSA mistake

"Our experience has been that those mostly add to confusion instead of making things more clear," he says. "Students and families don't understand why things change and we don't want to add to their stress."

Instead, they're trying to be transparent about timelines, and sending frequent updates to students and parents who have already submitted their forms.

Towson University, outside Baltimore, is taking a similar approach. Boyd Bradshaw, who runs the admissions and financial aid offices there, says he wants families to know the school will be flexible.