Essay on Pocket Money Advantages and Disadvantages

Students are often asked to write an essay on Pocket Money Advantages and Disadvantages in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Pocket Money Advantages and Disadvantages

Introduction.

Pocket money is a small amount of money given to children by their parents. It’s an effective tool to teach kids about financial responsibility.

Pocket money can teach children to manage money from an early age. They learn to save, spend wisely, and understand the value of money.

Disadvantages

However, pocket money can also lead to bad habits. If not monitored, kids might spend it all at once or buy unnecessary things, thus not learning proper money management.

250 Words Essay on Pocket Money Advantages and Disadvantages

The concept of pocket money.

Pocket money is a widely accepted practice where parents give a certain amount of money to their children for their personal expenses. It is seen as a tool for teaching financial responsibility and independence.

Advantages of Pocket Money

Pocket money can be a significant tool in a child’s understanding of financial management. It teaches them the value of money, how to budget, and the importance of saving. It can also help them understand the difference between needs and wants, and the consequences of impulsive spending. Furthermore, it can foster a sense of independence and responsibility, as they learn to manage their own finances.

Disadvantages of Pocket Money

On the flip side, pocket money can also have its drawbacks. If not monitored, it can lead to a sense of entitlement or promote materialistic attitudes. It might also lead to poor spending habits if children are not guided properly. In extreme cases, it could even lead to financial recklessness, as some children might assume that money is easily available.

Striking a Balance

The key to leveraging the benefits of pocket money lies in striking a balance. Parents should provide guidance and establish rules about spending and saving. They can use this as an opportunity to teach their children about the importance of charitable giving.

In conclusion, while pocket money has its pros and cons, it is an effective tool for teaching financial responsibility if used judiciously. The advantages can significantly outweigh the disadvantages with the right guidance and rules in place.

500 Words Essay on Pocket Money Advantages and Disadvantages

Pocket money, often a child’s first encounter with financial responsibility, is a topic of great debate. While some view it as an essential tool for teaching financial literacy, others perceive it as potentially leading to financial recklessness. As college students, understanding the pros and cons of pocket money can provide valuable insights into personal financial management.

The first significant advantage of pocket money is that it fosters financial literacy at an early age. By managing a fixed amount of money, children learn the value of money, budgeting, and prioritizing needs over wants. This early exposure to money management can be instrumental in developing sound financial habits, which are crucial in adulthood.

Pocket money also promotes a sense of independence and responsibility. Being entrusted with their own money, children learn to make decisions about spending and saving. This autonomy can boost their confidence and decision-making abilities.

Furthermore, pocket money can be used as a tool to incentivize good behavior or performance. It can serve as a reward system, encouraging children to complete chores, excel in academics, or engage in other positive behaviors.

Despite the benefits, pocket money is not without its drawbacks. One potential issue is that it can lead to a sense of entitlement. If children are given money without any conditions, they may develop the expectation of always receiving money, leading to a lack of appreciation for hard work and the value of money.

Another concern is the potential for financial mismanagement. Without proper guidance, children may spend their money impulsively, leading to poor financial habits. This could potentially carry over into adulthood, leading to financial difficulties.

Additionally, pocket money can create social disparities among peers. Children who receive larger amounts may feel superior, while those who receive less may feel inferior. This can lead to social issues, such as bullying or feelings of inadequacy.

In conclusion, pocket money can be a double-edged sword. On one hand, it can foster financial literacy, independence, and responsibility. On the other hand, it can lead to a sense of entitlement, financial mismanagement, and social disparities. The key lies in how it’s implemented. Parents and educators should use pocket money as a tool for teaching financial responsibility, coupling it with appropriate guidance and realistic expectations. As college students, reflecting on our experiences with pocket money can provide valuable insights into our own financial behaviors and attitudes, enabling us to make more informed financial decisions in the future.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Money

- Essay on If I Were a Butterfly

- Essay on I am a Butterfly

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The Great Debate – Pros and Cons of Pocket Money

by Lacey | Sep 9, 2014 | Parenting , Pocket money , Relationships , Teaching kids about money | 1 comment

In this extreme social experiment we call parenting, choices abound. From contentious issues like vaccination, to comparatively trivial ones like when to cut your child’s hair for the first time, we are bombarded opinions on what and what not to do, often in no uncertain terms. Ah, the glorious interweb, font of information (but not necessarily wisdom). So, if you’ve been getting lost trying to navigate the debate around the pros and cons of pocket money, let me assure this one’s completely subjective. Without further ado.

POCKET MONEY!

In this post, I try spare you the overload of the ‘pocket money should be earned’ debate. I will cover the pros and cons of pocket money, four ways you can go about setting it up, and some simple tools to help you work out which method is right for you and your child.

The four ways parents manage pocket money

I’ve spoken with a lot of parents about how they manage their child’s pocket money and I have observed four basic methods. They are:

- By allowance

- Per task and

- By negotiation.

1. On Demand

This is where the child asks the parent whenever they need money for a specific item or event. The most common sentiment I hear from this group of parents is:

“I provide everything my child needs, so they don’t need pocket money.”

While technically correct, the reality is that they probably still get the same material outcomes as other kids who do receive pocket money, i.e. they get to go to the movies, or to buy a treat, or whatever else their little heart desires. It’s just that they have to ask permission for how that money is spent every time they want it. Really, it’s pocket money on demand and subject to the discretion of the parent. This is the only method that allows the parent to control how, when and on what money is spent.

2. By Allowance

This is the fixed amount approach: Mum and Dad give child X dollars a week/month/year, and it’s up to the child how that money is spent. The money is not a reward or payment for any particular behaviour or task, it’s a given. The exception to this is deprivation as a form of punishment – much like grounding, or banning from watching TV, you can hold back the allowance when your child behaves badly.

3. Per Task

This method most closely mirrors a wage or salary: do this task, and you will be paid accordingly. Different levels of pay can be associated with different tasks, and often the value varies with the amount of time or effort required for a given task. For example, you might offer $5 for stacking and unstacking the dishwasher for a week, or $10 for doing the washing up for the same period. It reiterates the concept of earning money through effort: a child who doesn’t want to earn much doesn’t have to do much, but if they want more pocket money they need to put in more effort.

4. By Negotiation

Perhaps the most entrepreneurial approach, this method not only varies the pay with the task, it requires the child to negotiate what that pay will be and what the deliverables are. Parents using this method set the expectation with their child that s/he will come to the parent with a proposal to complete a task and negotiate with the parent as to what it’s worth to them. This method can help children learn to spot demand: if a child knows both parents detest washing the car, they can charge a premium for that task. Be warned – kids are smart. They will work out how far they can push you with this. Of course, that’s exactly what we want them to do, but be prepared not to curse when it happens.

Which method is right for you and your child, right now?

Good news: there is no right or wrong answer! (Despite what Facebook parenting experts tell you!)

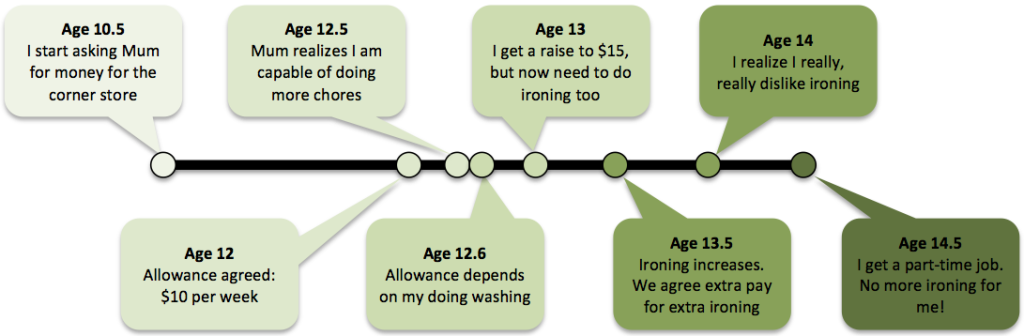

It’s a matter of personal choice, and you may find you use all four types at various points over the years. That was certainly the case for me – see below for the phases I went through with my Mum. It’s a cautionary tale in one way: I stopped doing the ironing at 14 ½ years, leaving Mum to iron everything except my school uniforms. I’ve ironed about twice a year on average ever since. (I REALLY detest ironing!)

A cautionary tale: my experience receiving pocket money

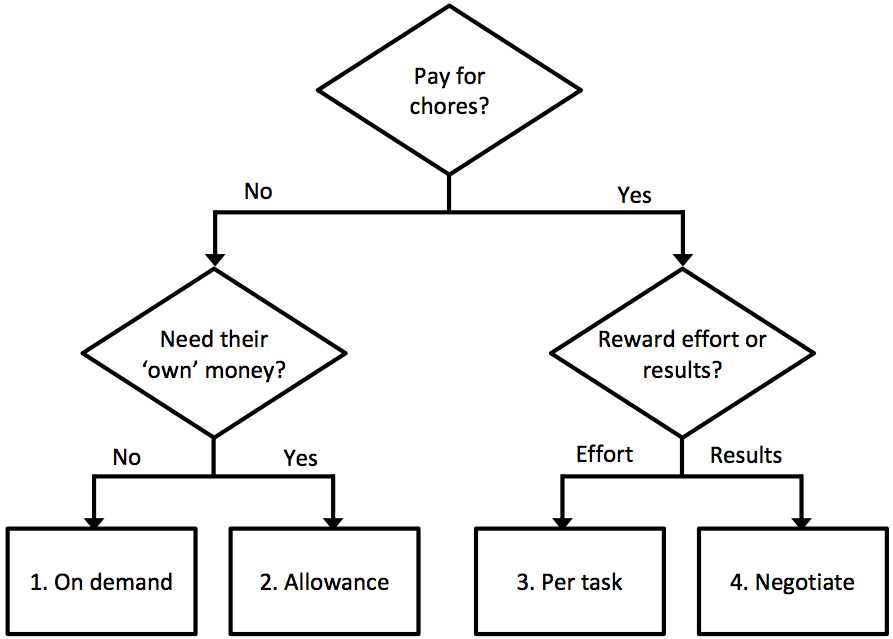

Ask yourself two questions

You can use the flow chart below to decide how you think pocket money will best work for you and your child, right now.

Start at the top and work your way down to one of the four pocket money methods

Still not sure? Let’s explore these questions in a bit more depth:

Question 1: Do you believe children should be paid for chores?

I was raised being paid for chores, so it never occurred to me to ask this question until a friend of mine recently offered an alternative point of view.

Her take on it was that chores are part of life – a responsibility we all share. No one pays Dad to cook dinner, or Mum to do the washing – it’s just what Dad and Mum do for the family. My friend believed that paying her child for chores would mean he missed a big lesson about contributing to family life and shared responsibility.

On the flip side, there are parents out there who think getting your child to do chores is robbing them of their all-too-fleeting childhood. Why shouldn’t they be rewarded financially for something that takes them away from the fun of being a kid?

Ah, moral questions. Enjoy wading through the quagmire on that one, or simply go with the majority of parents I’ve surveyed and pick ‘Yes’.

Question 2a: If you do believe children should be paid for chores, do you prefer to reward them for effort or results?

Assuming you went with the majority and said ‘Yes’ to paying your child for chores, the next question is whether you’re going to pay them for effort – their time or the type of task they undertake – or for the result they produce?

Not a question I’d considered much, until my mum reduced my pocket money for doing a crappy job of the ironing one week. Her explanation was simple: ‘I’m not paying you do something I’ll need to do again myself because you didn’t do it properly.’ Obviously, I was disgusted and went on strike to protest… until I wanted to go to the movies three days later.

In case you hadn’t guessed, my Mum is of the ‘results’ persuasion, which I theoretically agree with.

However, most jobs I’ve had do not reward results in the short term. They reward effort. If I stuffed up something while I was working, I had to do it again, but I got paid for the failed attempt anyway. I might not get another shift for a while, or I might eventually get fired for my poor productivity, but that week I got my paycheck. So, you could really argue either way for this one – your call!

Question 2b: If you don’t believe children should be paid for chores, do you believe children need some cash of their own?

At some point in their lives, our children are able to make their own decisions. When you think your child is ready to make such decisions relating to money, you are probably ready to let them have cash of their own by paying an allowance. If you think your child is not ready to make these kinds of decisions, you may prefer the ‘on demand’ method: simply providing the cash they need, when they want it, when you have discussed it.

Personally, I’d prefer NOT to have my hypothetical teenage son ask me for $10 so he can buy condoms. I’d rather he had the $10 to be responsible for himself.

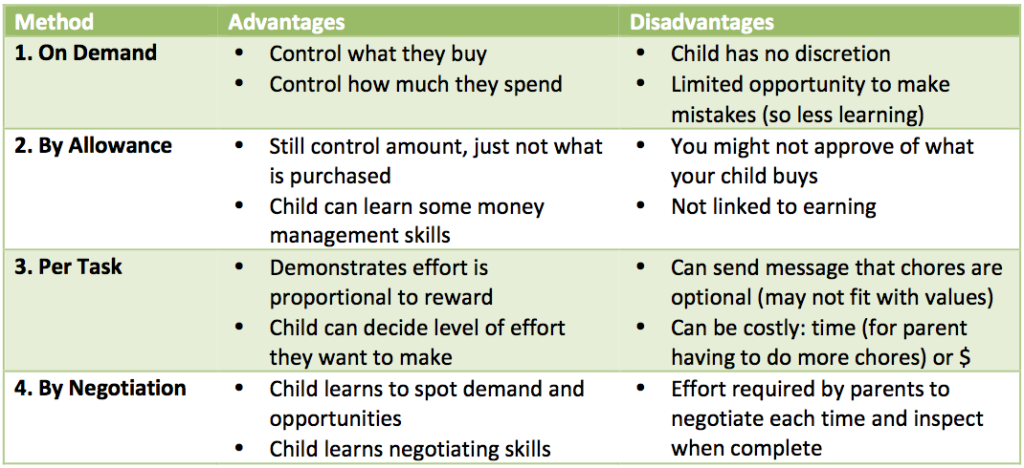

Pros and Cons of each method

If you’re still debating which way to go, you can consider the advantages and disadvantages in this table:

What’s next?

Perhaps your choice is obvious, perhaps it’s not. Maybe you want to set aside some time to speak to your child about it, depending on their age. Remember that all four methods can work – it’s up to you when and how you apply your choice, and you can always change your mind. Hooray for a parenting choice that’s not fraught with danger!

Do you have a story to share regarding pocket money? We’d love to hear it – please leave a comment below.

What comes next?

Download our Free Financial Resources

Find the right Money School Course for you

Get the Book: Money School, Become Financially Independent and Reclaim Your Life, Lacey Filipich

Got a question: Contact Us

Lacey Filipich is the co-founder and director of Money School. She helps parents raise financially savvy kids and helps adults get on top of their finances. Connect with her on LinkedIn and follow Money School Facebook to learn more.

Exceptional Info

Trackbacks/Pingbacks

- Future-Proof Kids Part 2 of 4: Raising entrepreneurs - LBD Group - […] problem in life, so every problem is an opportunity to demonstrate entrepreneurial thinking. Even pocket money can be used…

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

- Interviews & Personal Stories

- Negotiation

- Relationships

Money School

Pros and cons of pocket money – is giving an allowance a good idea?

Our money expert explores the benefits and drawbacks of pocket money and whether kids should have to earn the money they are given

- Sign up to our newsletter Newsletter

Pocket money can be a great way to teach children about the value of money and money management, but it has both its advantages and drawbacks.

Experts say giving your child an allowance can encourage them to take responsible decisions and build independence, and right now, teaching your kids about money has arguably never been more important.

You can also use a pocket money app to encourage your children to develop good money habits and then, as your offspring get older, you can look for the best bank accounts for kids .

Co-founder of money app GoHenry, Louise Hill , says: “It doesn't matter how much you give – it can be 5p or £5 – but the act of paying regular pocket money helps open up conversations around money, and gets children thinking about the four key pillars of money management: spending, saving, earning, and giving.

“You can help kids understand where it comes from; why it's important to save; that when it's gone, it's gone; and the role donating to people less fortunate plays in society. This is even more important as we move to a cashless society and children don’t see physical money exchanging hands in the way we used to.”

Pros of pocket money

According to GoHenry’s Youth Economy Report 2022 , the average pocket money received by children in the UK is £7.62 a week. Most parents increase pocket money with age, with seven-year-olds typically receiving £3.52 a week, 10-year-olds £4.58 and 16-year-olds £13.32.

But regardless of the amount, there are numerous advantages to giving pocket money.

GoodtoKnow Newsletter

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

1. It teaches children about money management

Having a set weekly allowance will help your children learn to prioritise and budget for the things they want. It will also teach them that their supply of money is finite.

Claire Saunders, certified financial coach at Mint Coaching , says “Pocket money is usually the first opportunity children have to learn and understand the value of money and to navigate financial responsibility. By receiving regular pocket money, children can make choices as they learn how to save, budget, and make spending decisions.”

2. Children can learn about earning money

Understanding the link between money and work is a vital part of kids’ financial education. For young children who aren’t old enough to get a part-time job, paid tasks can be a good introduction to the world of work.

Some parents might also tie pocket money into rewarding good behaviour. Dani Kumrou, mum to 12-year-old Ellie-rose and user of GoHenry, says: “When Ellie-rose was really young we had a reward chart where she’d get stickers for doing things like putting her toys away, eating her fruits and vegetables, playing nicely and sharing with her friends. We would then give her pocket money so she could save up and buy a new toy. So, she learned from a really young age that good behaviour pays rewards, and you should always be good and kind.”

3. It can help get your kids in the savings habit

Parents should encourage children to save a proportion of their pocket money for future large purchases – this can teach them about delayed gratification. You can encourage them to save by paying ‘interest’ on the money they put aside, or matching their savings for specific items.

Dr Lily Canter , a journalist and mother-of-two, says: “I have been giving my boys pocket money from a young age. They both got it from age six and they get £1 a week. It has really helped them to understand the value of money. If they want a magazine, toy or treat for example they have to buy it.

“They both got savings accounts at seven and top this up with their pocket money regularly. My eldest bought himself a laptop at age eight with the money he had saved from pocket money and birthday money from relatives.”

4. Children can apply maths skills to everyday life

Unfortunately, personal finance isn’t widely taught in schools. But maths is. By giving your kids pocket money you can tie the two subjects together and show your children real life examples of maths at work.

With young children, this can mean helping them calculate how much they will have left after spending some of their money. For older children, you might increase their pocket money in line with inflation or by a percentage.

Cons of pocket money

While there are numerous benefits of pocket money, there are significant disadvantages that should be considered.

1. It can be hard to spare the cash

If you’re strapped for cash at the moment, you might struggle to fit pocket money into your household budget. You might also think twice about giving your kids money if you think they will just fritter it away.

If you don’t have much money to spare, don’t feel pressured to give your kids a large amount. Even a pound or two a week can give young children the feeling of independence.

2. Some children might waste their pocket money

Without the right advice about money, some children may spend it as soon as they get it, rather than saving. They might also spend it on the ‘wrong’ things.

“There’s potential for teenagers to spend their pocket money on unhealthy or risky purchases – think alcohol, cigarettes or excessive amounts of junk food. A good way to manage this is to open up an app or account such as GoHenry, Natwest Rooster or Revolut, rather than giving them cash,” says a MoneyExpert spokesperson, “This way, you’ll have a better idea of how their money is being spent, whilst still giving them the financial freedom they need to learn.”

3. Watch out for entitlement

If your child doesn’t have to work for their money, he or she might develop a sense of entitlement, rather than realising money has to be earned. This could be the case if you are particularly well-off or give your kids an above-average allowance.

Goodto.com's Money Editor Sarah Handley says: "While your intentions may be generous, if you give your children too much pocket money it could harm their long-term relationship with money. They could be less motivated to earn their own money in the long run, or not fully grasp the idea and sense of achievement of saving up for a bigger purchase."

4. Money can provoke jealousy

Most parents increase the amount of pocket money they give their child as they get older. But this means older siblings get more than younger children – which can cause tensions.

Jealousy around money can be even more tricky outside of your family. Can your child cope with having more or less money than their friends? If this is of concern, it could be helpful to ask around to find out the going rate for pocket money in your child’s class.

Should children have to earn their pocket money?

According to a study by Halifax , more than four in 10 (44%) parents think children should only get pocket money if they do chores. But, perhaps unsurprisingly, more than half of children (55%) feel they should be given money, regardless of whether they do anything to earn it.

“Some parents believe that chores are a natural part of family life, and children should contribute to the household without monetary incentives. Others think that paying children for doing chores teaches them the importance of hard work and responsibility,” says Claire at Mint Coaching.

“In our family, we have chosen not to link pocket money to chores, as we believe helping round the home is a responsibility for the whole family. However, we might choose to pay our children if they are doing a ‘job’, that is outside of what we consider to be regular chores, such as cleaning the car.”

Emma Lunn is a multi-award-winning journalist who specialises in personal finance and consumer issues. With more than 18 years of experience in personal finance, Emma has covered topics including all aspects of energy - from the energy price cap to prepayment meter tricks, as well as mortgages, banking, debt, budgeting, broadband, pensions and investments. Emma’s one of the most prolific freelance personal finance journalists with a back catalogue of work in newspapers such as The Guardian, The Independent, The Daily Telegraph, the Mail on Sunday and the Mirror.

From superhuman growth to frizz and greasy roots, we grilled the experts on hair changes in pregnancy and the solutions to combat them

By Stephanie Maylor Published 1 April 24

We share conversation starters to help kids tackle online abuse

By Ellie Hutchings Published 1 April 24

Some mothers felt guilty for spending their partners money, while others saw it as household money instead

By Sarah Handley Published 1 April 24

The best zoos in the UK have been determined based on a number of key factors, include prices, popularity, Trip Advisor ratings and how many animals they have

By Sarah Handley Published 29 March 24

Child benefit is finally going to be made fairer - here's what's changing and when

By Sarah Handley Published 27 March 24

Presenter Helen Skelton has revealed how parents can keep costs low when keeping the kids occupied during school holidays

By Sarah Handley Published 22 March 24

New research has revealed how much the school holidays cost parents, and it's an eye watering sum - so we've shared our top tips on how families can keep costs under control

By Sarah Handley Published 20 March 24

Childcare costs have risen again, and only a worryingly small number of councils believe they have the supply to meet the demand of the final phase of the free childcare expansion, according a new childcare survey

By Sarah Handley Published 19 March 24

If you struggle to talk to your partner about your financial situation, try these five tips to get the conversation started

By Sarah Handley Published 18 March 24

The government has announced when the application window for 15 hours free childcare from nine months old will open

By Sarah Handley Published 15 March 24

Useful links

- Early signs of pregnancy

- Unusual baby names

- Fantastic facts for kids

- Kids party games

- Lemon drizzle cake

- Chocolate cake

- Basic cupcake

- Low calorie meals

- Best perfumes of all time

- Why am I so tired?

- How to stop drinking alcohol

- Contact Future's experts

- Terms and conditions

- Privacy policy

- Cookies policy

GoodtoKnow is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.

- Cost of living

Personal finance

- Product news

- Engineering

- Team Starling

- Money Explained

Which chores pay best? We talk to parents about the price they pay for peace

22nd March 2024

How to improve your credit score when renting

14th March 2024

Romance fraud: How to protect yourself

7th March 2024

What’s a mobile wallet?

20th February 2024

How do I future proof my business for a crisis?

8th February 2024

What’s the best age to start giving children pocket money, and how much?

19th January 2024

The pros and cons of pocket money

22nd September 2020

by: Team Starling

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

This week, Money Explained tackles the topic of pocket money, exploring the benefits and possible pitfalls. Our series looks at the money basics for everyone in the household, breaking it down into bitesize chunks.

Giving your children pocket money can be a great way to get them thinking about finances from an early age.

There are two general ways people give pocket money - either a regular allowance that is agreed upon and given each week no matter what, or money that’s conditional on the child doing certain jobs around the house like helping with the washing-up, hoovering, dusting the living room or a spot of gardening.

Pros and cons of pocket money

Many adults say that as kids get older and more independent, the act of giving pocket money can be a real conversation starter that can lead to lots of enlightening conversations. Other benefits of giving your kids pocket money include:

- Learning the value of money - by having their own cash, they can begin to see how much things are worth, and can decide whether to spend or save it.

- Allowing them to develop a healthy relationship with money – this is an important life skill.

- Helping to build their independence – by giving them some responsibility for their money.

- Discovering that money is something you work for - assuming they earn it by doing chores.

- Teaching that money you have can only be spent once - for example, if your child buys a new video game today, they won’t then be able to buy lego next week with the same money. Once you spend the money, it’s gone. This can help to start learning on how to budget and how to choose between buying different things.

Research has shown that money habits form early, as young as seven, and giving pocket money can really help to boost your child’s understanding of how money works .

It’s worth being aware of some possible negatives to giving pocket money as well:

- Your child could start to expect money for nothing - if you don’t peg their pocket money to work or tasks accomplished.

- It can create envy - if your child earns more or less than their friends.

Ways of giving pocket money

One option is to give your children cash for their pocket money, which you can then encourage them to look after and keep safe.

However, you might not always want to give them cash at all, especially with the current concerns around physical contact.

An alternative to cash is to make use of Starling Kite , a debit card for young people aged 6 - 15. It’s like a bank account, but as the adult, you get better control and visibility. Starling Kite is managed through our app, and you can load on pocket money in an instant. As the adult, you can also check and control specific activities such as cash withdrawals or online payments, and set daily spend limits. A Kite card comes ready blocked for merchants that aren’t age appropriate, including pubs and betting agents. Real-time notifications let you know exactly how they are spending.

Another useful thing about the Starling Kite option is the security. With Kite, if there’s ever a scare about the card being lost or stolen, you can lock / unlock the card with just a tap, in the app.

How much pocket money should I give?

This is a big question that we’ll look at in a future Money Explained article - ultimately it will come down to how much you can afford and how much you think your child should get, but we’ll explore factors you can use to help you decide.

You could also ask friends how much they give their kids, and encourage your children to chat to their friends about how much they’ve been able to save. Talking openly about money isn’t something that comes naturally to some people, but it’s really helpful for your children to learn that money isn’t a taboo topic.

Read the other articles in our Money Explained series :

Sharing and giving

Saving up for something special

Money: Needs vs wants

Teaching kids how to stay safe with money

How children learn about money

Different ways to pay

Find out more about Starling Kite

Related stories

Rachel Kerrone, Starling Director of Brand and Marketing and mother to three boys speaks with other parents about the best age to give pocket money to kids.

How to budget in 2024: Tools and features

Budgeting can help you plan your spending and identify where savings might be possible. Here are some of the Starling tools and features to help you budget.

3rd January 2024

All chores are not made equal. But which ones pay best? Our writer Charlotte Lorimer finds out.

For most people, credit scores are the unknown. It’s only when you review your finances more holistically that you realise the importance of them and how they can impact you. Here’s how they work.

Criminals can pretend to be someone they’re not, tricking individuals into believing they’ve found their ideal partner. Find out more about romance fraud.

You can use a mobile wallet to make payments quickly and conveniently, without relying on cash or a physical card. They are stored on your smartphone, tablet or smart watch.

Latest posts

Should Pocket Money be Given to Children?

Do you give your child pocket money or like other parents are you also confused? Pocket money has always been a major concern for most parents. Most families have a heated argument between parents and children for the same. Kids are keen to get money and wish to spend them on their own accord but on the contrary, parents are anxious and have their own set of doubts.

Most Indian parents think their kids are too small to deal with money. They are not only doubtful that their kids might get into the wrong company but think they may also misuse money and lead to self-harm. As each coin has 2 sides, similar is the case with this situation. Therefore, we cannot jump to a conclusion about whether pocket money should be given or not.

Advantages of giving pocket money :

Offering pocket money to children can be an excellent method to instill financial responsibility in them. It enables them to practise spending and saving as well as learn more about money management in general. According to our findings, the majority of German households regularly give their children pocket money. According to respondents , 71% of children aged 4 to 6 receive pocket money, rising to 95% for those aged 10 to 12. Only 13% of children aged 4 to 18 receive no personal money at all.

Be independent:

The most important benefit of giving pocket money is teaching kids to be independent and that’s the key to success in today’s time. When parents allow them to play with money, kids feel connected and they think their parents trust them. When they have money, they develop the ability to manage and learn its importance. Most parents feel that they might misuse the money given to them but unless you trust them and let them contribute to their expenses, they will never learn the difference between ‘use’ and ‘misuse’ of money.

Though there are some notorious kids and the best way to deal with them is to ask for the record of every single penny at the end of a week or a month. It works two in one. They will not only learn to use money wisely but this will also make them vigilant and smart to spend efficiently because, in the end, they know they have to submit the r eport to their parents .

Teaching kids the lesson and the importance of saving money:

What generally happens with most Indian kids is that by the time they reach adolescence they neither have much knowledge nor experience in dealing with money. This makes it difficult and they sometimes become a target of fraud. The reason being that they lack confidence and experience. The prime role which lies in parents’ part is not only to teach them the right use of money but also instil in them the value of savings. Complete your sentences by the use of suitable examples.

For instance, give them a real-life example of a person who resolved his problem because he had some savings with him. When you give them their fixed pocket money, ask them to keep some part of it in ‘Piggybank’. Start with a small penny and gradually increase the amount. Sit with them and help them draft their monthly expenditure chart. This way they will learn the efficient use of money. Let them plan the expenditure chart and try to mend it as well as teach them to save. For example, ask them to prefer Rs. 10 candy instead of Rs. 15, and see how happy they become to get Rs. 5 extra.

Teaching kids about the Value of Money:

Sometimes in the initial stage kids tend to spend more money on useless things. Let them do, be it partying, food, movies, stationery, or other things. In some time, they will realise they have no money to spend towards the end of the month on essential goods. Then let them figure out the flaws in their expenditure and mend them the next time. In this way, they will learn to value money. Let them take part in discussions for the monthly budget. Give them a game to save let’s say Rs. 200 in a particular month and appreciate their inputs as well. Tell them the things that are useful to purchase and what all to avoid. Sometimes take them for shopping as well. Give them a list of items and ask to manage the entire purchase within the money constraint. The best way to inculcate in them the value of money is to take their active participation and welcome their suggestions. The other way can be to ask them to save their pocket money to help the needy. Give them a time span of some months and use all their savings to buy gifts and clothes for the poor. This will encourage them to keep a portion of their pocket money as savings. In total, 89% of those polled say they have a strict pocket money schedule, with 36% providing their children money weekly and 53% giving them money monthly. In contrast, we discovered that some parents opt to choose when their children receive money:

11% of parents report that their children receive money when they need it, but not on a daily basis.

18% of parents give their children pocket money depending on their behaviour.

However, some families who adhere to a set timetable or amount say they are open to changes. 27% said they would reconsider the amount of pocket money they give their children based on the circumstances, such as special events, trips, and so on.

But yes, we cannot neglect the drawbacks of giving pocket money to kids. Have a look at them too.

Teaching kids about money management and how to invest pocket Money:

With money in their pocket, kids sometimes become callous with money. They start showing off this to their friends. Sometimes they might even get influenced by others and start comparing the amount of pocket money they and their friends receive. This sometimes hurt their ego and they start demanding for more pocket money from parents. They start speaking lies to get an increment in their pocket money. If this wish is left unfulfilled, in some worst cases, kids even go-ahead to steal money.

They don’t even realize what is wrong or right for them. Influence is a strong weapon, the only way to help your kids stay away from this is “awareness”. Before handing over money teach them values, once they become wise and sensible, there is no scope of such incidents to take place in the future. Tell them to stay cautious from all frauds or negative influence, by sharing real-life experiences.

Teaching kids about the spending of money :

With money by their side kids instil a sense of superiority and start targeting their subordinates or kids with lesser money to spend. They make fun of others and use bad languages against them. When children get too much freedom to spend money, they stop using their brains and spend money lavishly. Sometimes they even get fantasized about wrong habits. The presence of money tempts them to indulge in certain time-wasting habits be it, chilling in canteens, going out for movies, or addiction to junk food, smoking, drinking, or even gambling. All these are signs of kids developing bad habits. When not checked upon, these practices can turn worse, eventually, landing kids in a position where realizing the truth becomes difficult. This affects both physically and mentally. Excess addiction to junk food deteriorates health on a large scale leading to certain diseases. Kids start prioritizing money over other things and demand more money for expenditure. This has an adverse effect on studies as well.

Keep all these points in mind when you hand over money to your kids. There is as such no harm in giving pocket money but parents need to be extra cautious about when, how, and why to give money. A parent’s job is not limited to providing pocket money. They have to have a check on a timely basis and should stipulate the record of each penny given to them. This will make kids less liable to get inclined towards faux pas.

- Website Inauguration Function.

- Vocational Placement Cell Inauguration

- Media Coverage.

- Certificate & Recommendations

- Privacy Policy

- Science Project Metric

- Social Studies 8 Class

- Computer Fundamentals

- Introduction to C++

- Programming Methodology

- Programming in C++

- Data structures

- Boolean Algebra

- Object Oriented Concepts

- Database Management Systems

- Open Source Software

- Operating System

- PHP Tutorials

- Earth Science

- Physical Science

- Sets & Functions

- Coordinate Geometry

- Mathematical Reasoning

- Statics and Probability

- Accountancy

- Business Studies

- Political Science

- English (Sr. Secondary)

Hindi (Sr. Secondary)

- Punjab (Sr. Secondary)

- Accountancy and Auditing

- Air Conditioning and Refrigeration Technology

- Automobile Technology

- Electrical Technology

- Electronics Technology

- Hotel Management and Catering Technology

- IT Application

- Marketing and Salesmanship

- Office Secretaryship

- Stenography

- Hindi Essays

- English Essays

Letter Writing

- Shorthand Dictation

Pocket Money, Complete English Essay, Paragraph, Speech for Class 9, 10, 12 and Graduate Students Exam.

Pocket Money

Pocket money is what parents give to their children to spend. A child can spend his pocket money as he or she likes. Sometimes parents guide a child as to how to spend it wisely. Poor parents may not give pocket money to their children regularly. But they do give as often as they can afford. They give it, especially at festivals and fairs. My parents allow me a good amount of pocket money. It is not fixed. It varies from month to month. My father is a businessman. Whenever he is in a jolly mood because of good business, he gives me a fat purse as my pocket money. I do not spend all my pocket money. I save a part of it and deposit it in my bank account. I have opened a Savings Bank account in a nearby bank. I buy books on chess as it is my hobby. I have a good collection of books on the subject. Once in a while, I go to see a dance recital or a stage play with my friends. I also spend some of my pocket money on sweets and ice-creams. Once I helped Ravi to pay his school fee out of my pocket money. His father was away on a tour and he did not have sufficient money. He felt so obliged. After his father’s return, he soon gave me my money back. Last year I gave my mummy a pleasant surprise by presenting her with a beautiful watch on her marriage anniversary. I had bought it from the savings of my pocket money. I often buy things for my little sister out of it. She feels so delighted whenever I surprise her with sweets, a pencil box, and a fancy dress. My pocket money has helped me to learn how to spend wisely and save simultaneously. It is easy to spend, but to spend wisely is a bit difficult. But to save money is more difficult.

About evirtualguru_ajaygour

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Quick Links

Popular Tags

Visitors question & answer.

- Gangadhar Singh on Essay on “A Journey in a Crowded Train” Complete Essay for Class 10, Class 12 and Graduation and other classes.

- Hemashree on Hindi Essay on “Charitra Bal”, “चरित्र बल” Complete Hindi Essay, Paragraph, Speech for Class 7, 8, 9, 10, 12 Students.

- S.J Roy on Letter to the editor of a daily newspaper, about the misuse and poor maintenance of a public park in your area.

- ashutosh jaju on Essay on “If there were No Sun” Complete Essay for Class 10, Class 12 and Graduation and other classes.

- Unknown on Essay on “A Visit to A Hill Station” Complete Essay for Class 10, Class 12 and Graduation and other classes.

Download Our Educational Android Apps

Latest Desk

- The Future of Democracy in India | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Democracy Recedes as a Global Ideal | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Centre-State Financial Relations | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Presidential System is More Suitable to India | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Sanskrit Diwas “संस्कृत दिवस” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- Nagrik Suraksha Diwas – 6 December “नागरिक सुरक्षा दिवस – 6 दिसम्बर” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- Jhanda Diwas – 25 November “झण्डा दिवस – 25 नवम्बर” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- NCC Diwas – 28 November “एन.सी.सी. दिवस – 28 नवम्बर” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- Example Letter regarding election victory.

- Example Letter regarding the award of a Ph.D.

- Example Letter regarding the birth of a child.

- Example Letter regarding going abroad.

- Letter regarding the publishing of a Novel.

Vocational Edu.

- English Shorthand Dictation “East and Dwellings” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines.

- English Shorthand Dictation “Haryana General Sales Tax Act” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

- English Shorthand Dictation “Deal with Export of Goods” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

- English Shorthand Dictation “Interpreting a State Law” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

Pocket Money should be given to children. To what extent do you agree or disagree.

Unauthorized use and/or duplication of this material without express and written permission from this site’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to Writing9 with appropriate and specific direction to the original content.

- Check your IELTS essay »

- Find essays with the same topic

- View collections of IELTS Writing Samples

- Show IELTS Writing Task 2 Topics

Tourism is one of the fastest growing industries and contributes a great deal to economies around the world. However, the damage tourism can cause to local cultures and the environment is often ignored. To what extent do you agree or disagree?

The best way to educate children is by using the internet in every lesson.’ to what extent do you share this opinion what other ways are there of making lessons effective for children, today, many people do not know their neighbors in larce cities.what problems does this cause what can be done about this, some people say that the main environmental problem of our time is the loss of particular species of plants and animals. others say that there are more important environmental problems. discuss both these views and give your own opinion., the rise of convenience foods has helped people keep up with the speed of the modern life style. what are the advantages of this trend do the advantages outweigh the disadvantages.

Giving children and adolescents pocket money is common throughout the world Discuss the advantages and disadvantages of this practice and give your own opinion

Giving children and adolescents pocket money is common throughout the world. Discuss the advantages and disadvantages of this practice and give your own opinion.

After certain age parents usually gives pocket money to their children which is common across the world. Although this might have disadvantages, but advantages outweigh the drawbacks. In my opinion, pocket money will help teenagers to learn management skills and advantages of saving at early age.

Pocket money are usually provided for daily expenses. Teenagers need to manage lot of things like transportation cost, buying books, buying clothes and even going for a movie with friends. With a fix pocket money which is on monthly basis, teens can easily manage and plan their cost accordingly. Similarly, they can plan to save money for further expenses, for example, for a pinic or to watch a football match. Likewise, teenagers can save money for their hobbies, like to buy a sport kit for cricket, with this parents will have less burden on the expenses for them. Additionally, pocket money can help them to understand the importance of money in daily life, which could help them to recognise the importance of studying.

Pocket money will be also helpful to teenagers that could encourage them to earn extra income with part time works. Since many teenagers would feel that given pocket money is not enough they will search for extra income and likewise they could involve themselves in part time working jobs which will help them in their career growth.

Since every coin have two sides, pocket money could also lead to teenagers ending up buying addictive stuffs like drugs or cigarettes. A research from local Government inform that 30 percent of drugs are consumed by people between age of 15-18. Another drawback could be children bunking their lecture to attend a movie show or concerts.

In conclusion, providing pocket money to the teenagers will help them to manage their day to day schedule. However, parents should monitor their expenses where they have used their pocket money in order to keep them away from addictive things. Children are the future of next generation they must be protected.

- Log in or register to post comments

Essay evaluations by e-grader

Grammar and spelling errors: Line 1, column 1, Rule ID: SENTENCE_FRAGMENT[1] Message: “After” at the beginning of a sentence requires a 2nd clause. Maybe a comma, question or exclamation mark is missing, or the sentence is incomplete and should be joined with the following sentence. After certain age parents usually gives pocke... ^^^^^ Line 8, column 97, Rule ID: THIS_NNS[1] Message: Did you mean 'these'? Suggestion: these ...ke to buy a sport kit for cricket, with this parents will have less burden on the e... ^^^^ Line 12, column 100, Rule ID: EN_COMPOUNDS Message: This word is normally spelled with hyphen. Suggestion: part-time ...ncourage them to earn extra income with part time works. Since many teenagers would feel ... ^^^^^^^^^ Line 12, column 172, Rule ID: WHITESPACE_RULE Message: Possible typo: you repeated a whitespace Suggestion: ...agers would feel that given pocket money is not enough they will search for extra... ^^^ Line 13, column 95, Rule ID: EN_COMPOUNDS Message: This word is normally spelled with hyphen. Suggestion: part-time ...kewise they could involve themselves in part time working jobs which will help them in th... ^^^^^^^^^ Line 15, column 136, Rule ID: A_UNCOUNTABLE[1] Message: Uncountable nouns are usually not used with an indefinite article. Use simply 'research'. Suggestion: Research ...ictive stuffs like drugs or cigarettes. A research from local Government inform that 30 p... ^^^^^^^^^^ Line 15, column 169, Rule ID: HE_VERB_AGR[8] Message: The proper name in singular (Government) must be used with a third-person verb: 'informs'. Suggestion: informs ...ettes. A research from local Government inform that 30 percent of drugs are consumed ... ^^^^^^

Transition Words or Phrases used: accordingly, also, but, however, if, likewise, similarly, so, for example, in conclusion, in my opinion

Attributes: Values AverageValues Percentages(Values/AverageValues)% => Comments

Performance on Part of Speech: To be verbs : 9.0 13.1623246493 68% => OK Auxiliary verbs: 20.0 7.85571142285 255% => Less auxiliary verb wanted. Conjunction : 8.0 10.4138276553 77% => OK Relative clauses : 8.0 7.30460921844 110% => OK Pronoun: 27.0 24.0651302605 112% => OK Preposition: 48.0 41.998997996 114% => OK Nominalization: 6.0 8.3376753507 72% => OK

Performance on vocabulary words: No of characters: 1711.0 1615.20841683 106% => OK No of words: 333.0 315.596192385 106% => OK Chars per words: 5.13813813814 5.12529762239 100% => OK Fourth root words length: 4.27180144563 4.20363070211 102% => OK Word Length SD: 2.42837313755 2.80592935109 87% => OK Unique words: 175.0 176.041082164 99% => OK Unique words percentage: 0.525525525526 0.561755894193 94% => More unique words wanted or less content wanted. syllable_count: 504.9 506.74238477 100% => OK avg_syllables_per_word: 1.5 1.60771543086 93% => OK

A sentence (or a clause, phrase) starts by: Pronoun: 4.0 5.43587174349 74% => OK Article: 1.0 2.52805611222 40% => OK Subordination: 4.0 2.10420841683 190% => OK Conjunction: 1.0 0.809619238477 124% => OK Preposition: 9.0 4.76152304609 189% => OK

Performance on sentences: How many sentences: 17.0 16.0721442886 106% => OK Sentence length: 19.0 20.2975951904 94% => OK Sentence length SD: 37.4871604317 49.4020404114 76% => OK Chars per sentence: 100.647058824 106.682146367 94% => OK Words per sentence: 19.5882352941 20.7667163134 94% => OK Discourse Markers: 6.05882352941 7.06120827912 86% => OK Paragraphs: 15.0 4.38176352705 342% => Less paragraphs wanted. Language errors: 7.0 5.01903807615 139% => OK Sentences with positive sentiment : 13.0 8.67935871743 150% => OK Sentences with negative sentiment : 0.0 3.9879759519 0% => More negative sentences wanted. Sentences with neutral sentiment: 4.0 3.4128256513 117% => OK What are sentences with positive/Negative/neutral sentiment?

Coherence and Cohesion: Essay topic to essay body coherence: 0.16959546845 0.244688304435 69% => OK Sentence topic coherence: 0.0681622515407 0.084324248473 81% => OK Sentence topic coherence SD: 0.0620249274209 0.0667982634062 93% => OK Paragraph topic coherence: 0.0710299630153 0.151304729494 47% => OK Paragraph topic coherence SD: 0.0694553116065 0.056905535591 122% => OK

Essay readability: automated_readability_index: 12.6 13.0946893788 96% => OK flesch_reading_ease: 60.65 50.2224549098 121% => OK smog_index: 3.1 7.44779559118 42% => Smog_index is low. flesch_kincaid_grade: 9.5 11.3001002004 84% => OK coleman_liau_index: 12.53 12.4159519038 101% => OK dale_chall_readability_score: 7.71 8.58950901804 90% => OK difficult_words: 66.0 78.4519038076 84% => More difficult words wanted. linsear_write_formula: 7.0 9.78957915832 72% => OK gunning_fog: 9.6 10.1190380762 95% => OK text_standard: 13.0 10.7795591182 121% => OK What are above readability scores?

--------------------- Maximum five paragraphs wanted. Rates: 73.0337078652 out of 100 Scores by essay e-grader: 6.5 Out of 9 --------------------- Note: the e-grader does NOT examine the meaning of words and ideas. VIP users will receive further evaluations by advanced module of e-grader and human graders.

The Best Blogs to read daily

Advantages And Disadvantages Of Giving Pocket Money To Children

In this article we are going to talk about the Advantages and Disadvantages of giving Pocket money to children. During the childhood period, a child always has to depend on the parents for money. At the age of childhood, a child cannot earn money on their own and thus needs to depend on their parents. Although parents would be beside their children at every aspect of their life but there might be some situations where you won’t be with your children and your children needs money. At that particular moment pocket money comes into play and would be beneficial for your child if you give your children pocket money.

But beside having a benefit of pocket money, just like other things it has it’s other side too i.e. a bad effect on children. Therefore it’s a must to go through both the sides of giving pocket money to children before a parent makes his/her final decision on whether they should give pocket money to their children or not.

There would be some important life lessons which your children will get once they get a specific amount of money for a duration instead of just asking money from the parents at every single aspect of life.

5 Advantages of giving Pocket money to children

Some of the advantages of giving pocket money to children are discussed below in detail:

1. All-round growth

Modern society or the prevailing society in which we remain relies heavily on money and the financial system. Therefore understanding money is an important aspect of one’s life. Understanding money is also important to become an all rounded person. Therefore the sooner the person learns about it, the better it would be. Therefore, children must be provided with pocket money as this way they will be able to understand and know where to spend money and where to save money as they have to live with the fixed money for a fixed duration of time.

Click Here: Best Personality Development Blogs

2. Help in case of any emergency

No doubt, a parent will never leave their children alone but still there are some moments in their life but still there are some moments of life where because of any important work you may have to leave them alone. This kind of case can be termed as an emergency and if pocket money is given to the children than you don’t have to worry about them. Beside this there would be a situation when they are stuck at any place or are left behind and if they have the money of their pocket money, they will return safely to their home.

Read Also: How to Improve Your Thinking Capacity?

3. Money management

As pocket money is fixed and is given for a certain period of time, therefore children will learn the value of money and will start developing management skills . This will help the children in managing their money in a good way and thus keeping it for a longer duration of time. Not only this, but also they will be spending the money given to them wisely and will avoid any kind of spending of money unnecessarily.

Read Also: Importance of Time Management Skills

4. Learning value of money

In starting, it would happen with children that they would spend their pocket money in no time . And later on they would have left with no money to spend. This will in real help the children to understand the real value of money and how difficult it is to earn it and save it. With the time , they will came to know that it’s better not to spend money all at once, but instead should save it and should only spend once the right time has come.

Read Also: Why We Should Develop Good Habits?

5. Self-Dependency

There would be a thought in parent’s mind that by them a good amount of money at the same time would spoil the nature of their child as they will be obtaining money without any kind of hard-work. But it is not the case. In starting it would happen and parents would also feel like, but if you follow strict schedule than you would actually see developing a positive attitude in your child and this will also allow a certain level of independence in the children. This self-dependency would not be finding in the children who don’t get pocket money.

Read Also: How to Improve Will Power?

5 Disadvantages of giving Pocket money to children

Some of the disadvantages of giving pocket money to children are discussed below in detail:

As they will be getting a lumpsoms of money at the same one therefore, it would be a dream come true for them. Therefore, without thinking they would just start spending the money unnecessarily. And if they even spend it whole they would return to their parents asking them for more money. This is the time where thing worsens. If parents start giving them more money, the children instead of getting better would actually become worse and will develop and attitude of spending the money whenever they want and on anything on which they want to spend their money.

Read Also: Why is it Important to Have Good Communication Skills?

2. No supervision

Many parents out there will think that once they have given money to their children in the form of pocket money, their job is over. But in actual this is the time their actual job begins. Parents should take care of the things on which their children would be spending the pocket money they have been given. If the supervision is not done, than they just might spend the money on wrong things and become addicted to them. This will in return have a bad effect on the child which parents would have not wanted ever in their life.

Read Also: What are the most important things to learn in life?

3. Being bullied

It is a rare case but still it can’t be ignored. You never know a child behavior. If somehow the seniors of your children came to know about the pocket money of your children, than your child might eat bullied by the seniors or even from his classmates if the child does not possess a strong attitude and a courageous behaviors. Being bullied never left a good impact on any of the child out there. Thus when you were thinking of making your child self dependent after giving him pocket money, the child would in fact more dependent on the parents even for protecting him from his classmates or seniors.

Click Here: Interesting Articles

4. Too young

Childhood is the age where its considered too young to get maturity level. Hardly 1 child is there who can get mature to know where the money should be spent which is given in the form of pocket money. Beside this, there would be cases that instead of learning the importance of money, it happen just opposite and children does not realize the worth and value of money. They start taking hasty decisions and wrong decisions in their life which instead of giving a good response in the child life, will make his life more miserable .

Read Also: What to do on the internet when you are bored?

5. Unnecessary expenses

When children got a lump-sum of money together they always wish to spend it. Sometimes it can be that during their time duration when they are supposed to spend the money, they are not able to spend it and in the end they still have enough pocket money left with them to spend. This is one of the biggest disadvantage now. With so much money in hand, and less time to spend they tend to buy a thing which they will find fancy and attractive at first sight but after buying it, will not be font of it. Beside this, just for the sake of spending money, they also might spend it on unnecessarily and wasteful things.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related Posts

10 Best Skin Care Tips For Men

What Are The Habits Of Unsuccessful Students?

Can A Married Man And A Married Woman Be Just Friends?

Pocket Money, Should Parents develop this habit at the tender age?

Any economy, any Country, any Company, even an NGO or the smallest company need resources to achieve its objectives; but it is a known fact that the resources are always limited, and need to be used optimally. This is the reason why even the developed and resourceful countries also prepare a budget for the optimal use of resources. Similarly, every person also has his own budget for his personal expenses or for the expenses of his family.

Usually, it has been seen that a person starts budgeting after he starts earning; till that time his parents provide him with everything he needs (depending on the budget of the family). Because of this, he fails to understand the importance or the value of money and cannot prioritise his necessities and luxuries immediately as he starts earning and soon realises the Hindi saying that 'Aish to Baap ke Paise se Hoti Hai, Khud ke Paison se to Sirf Zarooratain Poori Hoti Hai'. But this could be avoided, if they are put into the habit of planned and prioritized expenditure at their tender age; it would not only help them to cut down few of the unnecessary expenses but also make them realise the value of their parents' and in coming times their own hard earned money.

Developing the habit of pocket money at a very young age thus will play an important role in person's development and will develop different management, financial and strategical skills in them. Quite possibly, this might help them and the whole economy of which he is a part to develop good resource management and to flourish even with meagre resources.

But having access to money at such an immature age may, at first, tempt the kid to spend on his cravings; this might lead to constant demand of increment and on refusal, probably to the theft. So, along with giving a free hand, some restrictions or specifically a check should be maintained. A kid should be taught and encouraged to keep an account of his expenditures; and rather than constantly nagging him, the habit of self-analysis should be developed. This habit of self-analysis might let him learn from his own mistakes and take better decisions in future.

Pocket money might help them realise the importance of available resources and its optimal use but not the importance of hard work; so, instead of simply giving away the money, they should be asked to do some simple works such as washing car, cleaning utensils, etc. Also, the care needs to be taken that this 'Money for Work' should only be an encouragement to work and not turn into the employer-employee relationship. For this, the inevitable expenses such as school fees, books, uniform etc. should be borne by parents. Also, to maintain the warmth of the relationship, birthday parties or some trips also need to be arranged by the parents and not charged upon the pocket money of kids.

Thus, developing the habit of pocket money helps making the kid realise the importance of available resources, labour, savings and developing many other skills such as budgeting, management, decision-making etc. But, while inculcating these, it should be taken care of that the warmth of parent-kid relationship is maintained and the kid doesn't get into wrong practices such as theft or bribe.

Hiral D. Myatra

Related Essay

- Essay on Importance of pocket money

- pocket money should be given to children. do you agree or disagree?

- Essay on pocket money advantages and disadvantages

- Essay on pocket money should be given or not

- Should pocket money be given to students?

- Essay on pocket money should not be given to students

- why should parents give pocket money

- Should Parents Give Their Children Pocket Money?

- pros and cons of pocket money

- Advantages and disadvantages of allowance to kids

- Pros And Cons Of Giving Children An Allowance

- Discuss on pros and cons of pocket money for kids?

- UPSC Final Results 2019 New

- UPSC Mains Results 2022 [ New ]

- Free CSAT Practice Test

- Practice Prelims Test Series 2024 [ New ]

- UPSC Videos

- Daily UPSC Current Affairs Quiz [ Free ]

- UPSC Results

- Prelims Question Papers

- Prelims Marks Distribution

- General Studies Notes [ Free ]

- Current Affairs

- UPSC Prelims Syllabus

- UPSC Mains Syllabus

- UPSC Jobs List

- UPSC Subjects

- UPSC Age Limit

- IAS Full form

- Free UPSC Material

- IAS Exam Book

- How to prepare for prelims 2023

- How to prepare for CSAT

- UPSC Study Material

- UPSC Interview Questions

- UPSC IAS Exam Questions

- Economic Survey 2020-21 Download

- Union Budget 2020-21 Download

- National Education Policy 2020 Download

- Daily UPSC Current Affairs Quiz

- Union Budget 2024-25 [ New ]

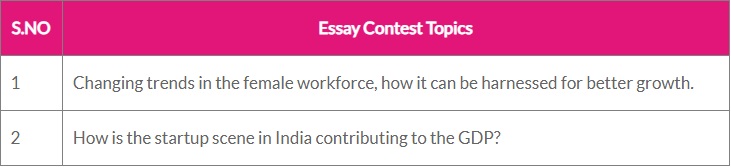

Civil Service Essay Contest March 2024

- Changing trends in the female workforce, how it can be harnessed for better growth.

- How is the startup scene in India contributing to the GDP?

Civil Service Essay Contest (December 2023)

- Is the caste barrier breaking due to increased love marriages in India? Views : 1350

- Is the caste barrier breaking due to increased love marriages in India? Views : 1856

Current Affairs Analysis

Upsc civil service examination 2024 notification to be out on february 14, check details.

Views : 3797

Tsunamis are here to stay as it hits Japan

Views : 5537

Floods and the Monsoon in India

Views : 5388

Use of AI in the field of meteorological research

Views : 1178

Update on National TB Elimination Programme

Views : 6662

Goa Liberation Day

Views : 6305

About Civil Service India

Civil Service India is a website dedicated to the Civil Services Exam conducted by UPSC. It guides you through the entire gambit of the IAS exam starting with notification, eligibility, syllabus, tips, quiz, notes and current affairs. A team of dedicated professionals are at work to help you!

Stay updated with Us

Phone : +91 96000 32187 / +91 94456 88445

Email : [email protected]

What are the Advantages and Disadvantages of Money? – Answered!

Read this article to learn about Advantages and Disadvantages of Money!

Advantages of Money:

Paper money has got several advantages and disadvantages.

The following advantages can be mentioned:

(i) Economical:

ADVERTISEMENTS:

Paper money practically costs nothing to the Government. Currency notes, therefore, are the cheapest media of exchange. If a country uses paper money, it need not spend anything on the purchase of gold or minting coins. The loss which a country suffers from the wear and tear of metallic money is also avoided.

(ii) Convenient:

Paper money is the most convenient form of money. A large amount can be carried conveniently in the pocket without anybody knowing it. It is very risky to carry on one’s person Rs. 5,000 in cash, but not in notes. It possesses, in a very large measure, the quality of portability which a money material should have. In a very small bulk, it can contain a very large value. Think of a currency note of Rs. 10,000.

(iii) Homogeneous:

One essential quality in money is that it must be exactly of the same type. Even among the coins there are good and bad coins. But currency notes are all exactly similar. It is, therefore, a very suitable medium of exchange.

(iv) Stability:

The value of paper money can be kept stable by properly regulating its issue. That is why there are many advocates of ‘managed’ paper currency.

(v) Elasticity:

Paper money is absolutely elastic. Its quantity can be increased or decreased at the will of the currency authority. Thus paper money can better meet the requirements of trade and industry.

(vi) Cheap Remittance:

Money in the form of currency notes can be cheaply remitted from one place to another in an insured cover.

(vii) Advantageous to Banks:

Paper money is of very great advantage to the banks. They can keep their cash reserves against liabilities in this form, for currency notes are full legal tender.

(viii) Fiscal advantages to the Government of the paper currency are undoubtedly very great, especially in times of national emergencies like a war. A modern war cannot be prosecuted by taxes or loans alone. All governments have to resort to the printing press. In recent years in India there has been great inflation. We must remember that by this means our Government has been able to spend hundreds of crores of rupees on various ambitious programmes of development. Hence within limits the issue of paper money comes very handy to the government at the time of dire need.

Disadvantages of Paper Money:

But we cannot overlook the disadvantages of money:

(i) Paper money is of no value outside the country of issue. Gold and silver coins are accepted even by foreigners, as they have got some intrinsic value.

(ii) There is a possibility of the damage to paper. Fire may burn it; if the place is flooded, it is gone; it may also be eaten up by white ants.

(iii) A serious drawback in paper currency is the ease with which it can be issued. There is always a danger of its over-issue when the Government is in financial difficulties. The temptation is too great to be resisted. Once this course is adopted, however, it gathers momentum and leads to further note-printing, and this goes on till the paper currency loses all value. This happened in various countries in recent times: in Russia (1917), in Germany (1919), in China (1944), and so on.

An over-issue of notes, in other words ‘inflation’, brings many evils in its train.

Some of them are:

(a) Prices rise steeply. As a result, labourers and people with fixed incomes suffer greatly. The whole public feels the pinch.

(b) The indirect result of the excessive rise in prices is a fall in exports and a rise in imports. This leads to the export of gold from the country, which is not a desirable thing. Its balance of payments becomes unfavorable.

(c) The rise in prices also leads to a fall in the external value of the home currency. The rate of exchange falls. More home money will have to be paid to buy units of foreign currencies.

Conclusion:

Really, paper money, if it is issued and regulated carefully, is without any disadvantage. All countries issue paper currency, and, in normal times, they do not suffer from it in any manner. Only when it is over-issued, it becomes a great danger and a curse. It may cause grave discontent among the masses. When paper money is over-issued, there is inflation and prices rise. It hits hard several important sections of the people like workers and fixed- encomiasts.

The people might lose confidence in the currency and it might become useless. Such a situation arose in many European countries during and after World War I, and later more recently in China. It is remarkable that Indian Government was able to control inflation, whereas even countries like the U.K. were unable to check it.

Related Articles:

- 3 Standards of Monetary Systems

- Advantages of Money: 8 Important Advantages of Money– Explained!

- Floating Exchange Rates: Advantages and Disadvantages | Currencies

- Money Supply – Meaning and Measures of Money Supply

Gain efficiency with my essay writer. Hire us to write my essay for me with our best essay writing service!

Enhance your writing skills with the writers of penmypaper and avail the 20% flat discount, using the code ppfest20.

Finished Papers

How to Order Our Online Writing Services.

There is nothing easier than using our essay writer service. Here is how everything works at :

- You fill out an order form. Make sure to provide us with all the details. If you have any comments or additional files, upload them. This will help your writer produce the paper that will exactly meet your needs.

- You pay for the order with our secure payment system.

- Once we receive the payment confirmation, we assign an appropriate writer to work on your project. You can track the order's progress in real-time through the personal panel. Also, there is an option to communicate with your writer, share additional files, and clarify all the details.

- As soon as the paper is done, you receive a notification. Now, you can read its preview version carefully in your account. If you are satisfied with our professional essay writing services, you confirm the order and download the final version of the document to your computer. If, however, you consider that any alterations are needed, you can always request a free revision. All our clients can use free revisions within 14 days after delivery. Please note that the author will revise your paper for free only if the initial requirements for the paper remain unchanged. If the revision is not applicable, we will unconditionally refund your account. However, our failure is very unlikely since almost all of our orders are completed issue-free and we have 98% satisfied clients.

As you can see, you can always turn to us with a request "Write essay for me" and we will do it. We will deliver a paper of top quality written by an expert in your field of study without delays. Furthermore, we will do it for an affordable price because we know that students are always looking for cheap services. Yes, you can write the paper yourself but your time and nerves are worth more!

Megan Sharp

Customer Reviews

Progressive delivery is highly recommended for your order. This additional service allows tracking the writing process of big orders as the paper will be sent to you for approval in parts/drafts* before the final deadline.

What is more, it guarantees:

- 30 days of free revision;

- A top writer and the best editor;

- A personal order manager.

* You can read more about this service here or please contact our Support team for more details.

It is a special offer that now costs only +15% to your order sum!

Would you like to order Progressive delivery for your paper?

How do essay writing services work?

In the modern world, any company is trying to modernize its services. And services for writing scientific papers are no exception. Therefore, now it is very easy to order work and does not take time:

- First, you need to choose a good site that you can trust. Read their privacy policies, guarantees, payment methods and of course reviews. It will be a big plus that examples of work are presented on the online platform.

- Next, you need to contact a manager who will answer all the necessary questions and advise on the terms of cooperation. He will tell you about the acceptable writing deadlines, provide information about the author, and calculate the price of the essay.

- After that, you sign the contract and during the indicated days stay in touch with the employee of the company.

- Then you receive the file, read it attentively and transfer a certain amount to the company's bank card. After payment, the client downloads the document to his computer and can write a review and suggestions.

On the site Essayswriting, you get guarantees, thanks to which you will be confident and get rid of the excitement. The client can ask any questions about the writing and express special preferences.

Essay Service Features That Matter

IMAGES

VIDEO

COMMENTS

1 month free, then £3.99/month. Get started today. Set up your card in minutes. Cancel anytime. The GoHenry pocket money card is a smart solution for managing your child's money and giving money to children, through an allowance prepaid card.

500 Words Essay on Pocket Money Advantages and Disadvantages Introduction. Pocket money, often a child's first encounter with financial responsibility, is a topic of great debate. While some view it as an essential tool for teaching financial literacy, others perceive it as potentially leading to financial recklessness.